Well, we had a week of firsts on the ASX last week. New all-time record highs abounded for the S&P/ASX 200 (INDEXASX: XJO) and the All Ordinaries (INDEXASX: XAO), which seems increasingly more normal and less newsworthy these days.

Commonwealth Bank of Australia (ASX: CBA) lost its long-held crown as Australia's largest listed company (albeit briefly) to the seemingly unstoppable CSL Limited (ASX: CSL). Wesfarmers Ltd (ASX: WES) sold $1.05 billion worth of Coles Group Ltd (ASX: COL) shares, dropping its total ownership of the grocer to 10.1%.

And (as usual) we had winners and losers – whose triumphs and tribulations were last week again amplified because we are in the midst of ASX reporting season.

How did the markets end last week?

Last Friday saw the ASX 200 close at 7,139 points, which was up 9 points (or 0.13%) from the start of the week. However, the ASX 200 reached a new all-time high watermark of 7,190.3 points on Thursday – pipping the previous record high of 7,132 points that was set last month on 22 January.

Perhaps somewhat perversely, this high was in no small part due to the release of the national unemployment figures this week, which indicated that the unemployment rate has ticked up from 5.1% to 5.3%.

A rising unemployment rate means the Reserve Bank of Australia (RBA) will be far more inclined to once again slice the official cash rate to what would be another record low of 0.5%.

This in turn would translate into lower discount rates for ASX shares and other assets – which is good news for the stock market and partly why we saw the markets surge last week. A slew of well-received earnings (including those from Coca-Cola Amatil Ltd (ASX: CCL) and Coles) didn't hurt either though!

Which ASX shares were the biggest winners and losers?

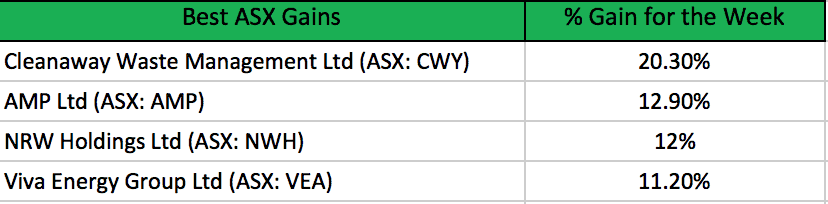

Here is a table that outlines the ASX winners for the week:

As we can see, Cleanaway Waste Management Ltd (ASX: CWY) was by far the week's biggest winner, with Cleanaway shares closing a healthy 20.3% higher on Friday than the week's commencement to finish the week at $2.31 a share.

The ASX's largest waste manager stunned the markets with a 13.7% lift in underling net profits and a 15.2% list in earnings per share. In a pleasing result for dividend investors, Cleanaway also raised its interim dividend to 2 cents per share – a 21.2% increase on the prior year's payment. The company also raised its expectations/guidance for the back half of the financial year.

Adding to the winners this week was AMP Ltd (ASX: AMP), which seems to be continuing on its road to redemption and finished the week with a share price above $2 for the first time since July last year – closing at $2.06 on Friday.

AMP shares are now up 31% since touching its lowest share price in living memory at $1.57 last October. There was no major news out of the company last week that explains such a healthy jump, so we can only conclude that the confidence of institutional investors is slowly returning to this beleaguered wealth manager.

And of course, we have CSL. As discussed above, CSL briefly became the most valuable listed ASX company when it surpassed Commonwealth Bank of Australia on Thursday for the top crown. Now CommBank going ex-dividend on Wednesday didn't help its standing – and when CSL shares touched over $342 for the first time ever on Thursday, the deal was done. It's worth noting that CSL has subsequently pulled back somewhat and ended the week on $336.40, which puts the company on a market capitalisation of $152.69 billion (CommBank was sitting on $157.2 billion on Friday).

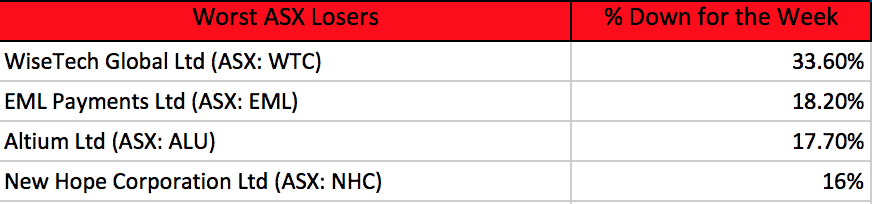

But if we have winners, so must we have losers and here they are for last week:

WiseTech Global Ltd (ASX: WTC) takes the wooden spoon home for last week with an eye-watering 33.6% haircut. WiseTech shares closed the week at $19.28, which is a painful far cry from the $29.06 price tag the market was asking just 7 days ago. This drop was precipitated by the company reporting its half-yearly earnings, which underwhelmed investors (to say the least) with modified guidance that warned of significant financial impacts from the coronavirus epidemic.

WiseTech reported revenue growth of 31% and earnings growth of 29%. But it was the revised guidance of earnings growth of between 5% and 22% (it was previously forecasting a 34–42% range) that really spooked investors. It's a stunning reversal of fortune for this formerly high-flying WAAAX company, which boasted a share price of close to double last week's closing price just a few months ago.

EML Payments Ltd (ASX: EML) also has a shaky week with a 17.7% fall. Like WiseTech, EML was hit by a wave of investor dismay at the reporting of its own half-year earnings. Despite the company reporting earnings growth of 42% and a 30% list in gross profits, investors didn't seem to respond well to the company's revised FY20 guidance. That is now estimated for revenues in the range of $120–$129 million, instead of $116–$132 million.

What is this week looking like for the ASX?

We have some more earnings to be reported this week on the ASX, which will no doubt assist in guiding the overall market sentiment. Companies reporting this week include Woolworth Group Ltd (ASX :WOW), which will join its rival Coles in revealing its performance for 1H20. Also turning up with their numbers will be WiseTech's fellow WAAAXer Appen Ltd (ASX: APX) and the A2 Milk Company Ltd (ASX: A2M).

Here is a list of the ASX 200's most famous blue-chips and how they stand as we start the new week.

And finally, here is the lay of the land for some leading market indicators:

- S&P/ASX 200 at 7,139 points

- ALL ORDINARIES at 7,230.4 points

- Gold is asking US$1,643.32 per troy ounce

- Brent crude oil is trading at US$58.50 a barrel

- Australian Dollar buying 66.27 US cents

Foolish takeaway

Earnings season so far has led to new all-time highs for the ASX and we might well see that trend continue this week with more ASX companies reporting. However, I think we are still yet to see the worst of the coronavirus outbreak's impact on the ASX, so enjoy the highs, but stay vigilant!