A common refrain you hear from younger people when asked about investing might go something like this: 'I've got all the time in the world' or 'I'll worry about that when I'm older'…. Maybe even 'I thought investing is for old people, right?… how old are you?'

Anyone who understands the powers of compound interest will warn you of the folly of these trains of thought. Often, just the time that you are investing can make more of an impact on your eventual returns than the raw cash you set aside to invest.

And one of the most frustrating things you hear, as someone who aims to spread and democratise the world of finance for all, is when older Australians tell you 'I wish I did this when I was younger'.

One of my Foolish colleagues over in the US recently outlined a similar predicament that older American investors are going through. According to this article at Fool.com, the number one piece of advice that people in their 40s, 50s, 60s and 70s would give their younger selves: start saving earlier.

What does this mean for us?

So, I thought I would look at how this might apply to us Aussies.

According to InvestorDaily, a survey conducted by National Seniors Australia and wealth-manager Challenger Ltd (ASX: CGF) has found that more than half of older Australians (specifically 53%) fear outliving their savings in retirement. Even more unfortunately, when the opinions of the women in the survey were taken alone, that number climbed to 59% (it was 47% for men).

According to the survey, those with less than $500,000 in savings at retirement age were 65% more worried about running out of capital.

Now, this does lead to questions about the viability of the relationship between the safety-net of the Aged Pension and the self-funded superannuation system. But that won't be the focus of today's article.

But the superannuation system is built on the principles of compound interest. As one of the architects of the current super system, former Prime Minister Paul Keating has said – the benefits of super is about interest earning interest and that interest earning interest on top.

Investing outside super is done best when you apply the same principles.

And that involves time, regular contributions and not withdrawing capital until you retire.

The power of compound interest

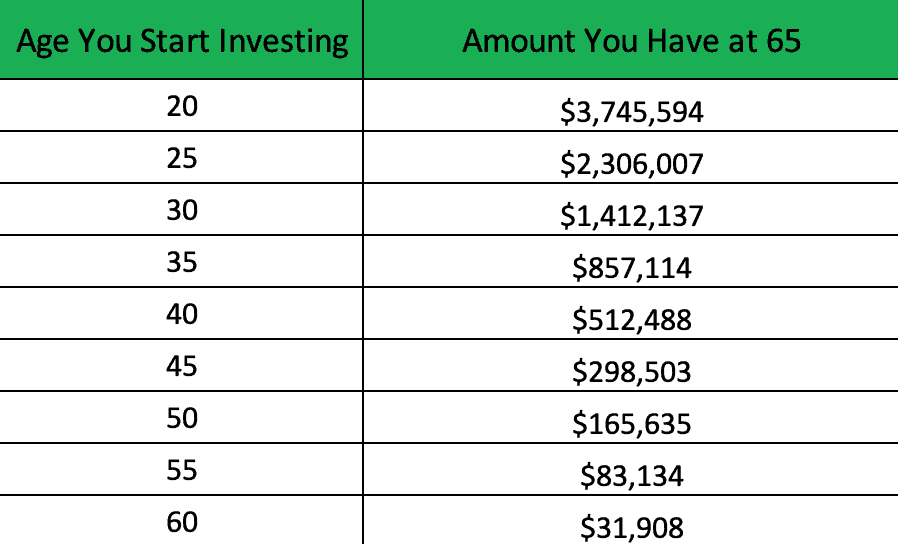

To demonstrate how much of a contribution that time alone can make to your total returns, have a look at this table below. It shows the returns you can expect by investing $100 a week with a 10% return based on different time periods.

Source: Yours Truly

Startling, isn't it?

It goes to show that if young people 'worry about it when I'm older', the amount of worry is exponentially greater than just sacrificing an amount of money each week to invest.

Now it's worth noting that most investments (especially shares) don't go up in a straight line like this table suggests. But investing over a long period of time does smooth the curve.

Also worth noting is that getting a 10% return is not guaranteed or easy. ASX index funds like the Vanguard Australian Shares Index ETF (ASX: VAS) have historically approached these levels, but future returns are not secured by this past performance.

Plus, we Fools like to think that with the right attitude to investing, anyone can beat the market return anyway.

But I digress. The main draw away from this table is how much of a stupendous impact pure time has on your returns.

The compounded benefit from that last five years (assuming someone starts investing at 20) before retirement is more than the combined aggregate for the first twenty years of your investing!

It's no wonder that older Australians often look back and wish they started investing sooner!

What now?

Well, if you're a young Australian reading this and haven't started investing yet, I hope you have sufficient motivation to start your journey.

Conversely, if you're a not-so-young-anymore Aussie… well you know what they say about the best time to plant trees. It was twenty years ago, but the second-best time is today!

And it doesn't even have to be ASX shares (although (big surprise) that's my personal favourite).

You could invest in a US share index fund or emerging markets.

You could start climbing the property ladder or invest in government bonds (although good luck trying to get a 10% return with them these days). Perhaps you could even start a business! As long as your interest/profits/rent/dividends are being reinvested and compounding at a decent rate, it doesn't really matter.

As long as you're doing something, you're on the right path!

Foolish takeaway

Again, the only three things to do are investing in the first place (and as much and regularly as possible), getting as good a return as you can and… time.

So don't be one of those people who is going to 'worry about it when I'm older'. Because the younger you start worrying about it, the better off you'll be.