Tesla: A case study

A couple of months ago, I had my first ride in a Tesla: the Model 3 of a mate.

In case you don't know, Tesla is…

I kid.

Of course you know.

Even if you're determinedly disinterested, you couldn't hide from the headlines, photos and social media frenzy if you tried.

So I'll assume you've heard of the company, seen the car, and are familiar with its never-boring CEO, Elon Musk.

You know how I know?

Check out these two paragraphs from a Wall Street Journal article, overnight:

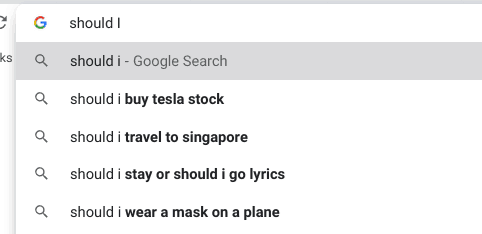

"In one sign of Tesla's place in the zeitgeist, typing "should I" into a Google search recently prompted an autofill that read "should I buy Tesla stock."

"For almost every bullish investor, there is an equally passionate bearish one. Another popular Google query last week read, "should I short Tesla."

I tested it. It's true:

I am somewhat rare among the 'investment community' (whatever the hell that is): I don't have a firm view on the company.

This, in an environment where one notable bull (a bull is someone who is positive about the future share price of a company) has a $7,000 target price on Tesla (close enough to 10x the current price) while a more famous bear (who is negative on the stock) is reportedly still expecting to profit from a lower share price in future.

I tried, hard, to think of a single company that has aroused such passionate and wide-ranging support and detraction, in seemingly equal measure, and I can't.

There have been times when market conditions have had that effect (I'm thinking the depths of the GFC in 2009 and the height of the dot.com bubble in 1999), but not a single stock.

And that's what makes it such an enigma.

There are very, very smart people on both sides of this trade.

That's not rare, but those people are at almost polar opposite sides.

It's one thing to say "I'm not prepared to buy CSL at $323, but I know I might be wrong" and for another group to say "I'm buying, because I think it'll do well, but I acknowledge it's not cheap".

It's another to be a Tesla true-believer or uber-critic.

Maybe it's a reflection of our hyper-partisan political times.

Or because of the type of company — and CEO — we're talking about.

I hope it's the latter. Because in that case, it's an isolated case.

But in a world where social media is polarising us like never before (remember the two Sydney mothers who came to blows over a Facebook disagreement recently?) I have to believe it's at least a little of the former.

Which is terrible news for investors.

I wrote last week about the idea of 'strong opinions, weakly held'.

That's a wonderful construct for us to think about the stocks we own (or don't) — having a well-formed view, but being ready to change it at a moment's notice.

Doesn't it seem that, courtesy of social media and the other things polarising us, the very opposite approach is being taken by an increasing number of people?

Isn't much of our discourse more accurately described as 'weak opinions, strongly held'?

And, before I get hate mail, I'm not saying all Tesla bulls are pig-headed ignoramuses, or that all Tesla bears are arrogant morons! Just that, given the sheer number of people espousing such extreme doubt-proof views, there must be a decent chance that a good proportion on either side don't have anywhere near enough expertise (or fortune-telling ability) to have such confidence in their assumptions.

Remember: there are smart, successful people on both sides of this trade, some with very impressive long-term track records.

Half of them are going to look like dills at some point. Not for being wrong, per se — all investors are wrong sometimes — but for being so certain, leaving way too little room for doubt.

(The worst part? Those who fit that description just responded to my sentence by thinking 'yeah, well it'll be those other idiots'!)

And for the rest of us? Well, when one of the top search suggestions for 'should I' is "buy Tesla stock", you know this story is getting silly.

But such is the passion and interest around the company.

As much was demonstrated at last week's Motley Fool Platinum member meeting: the topic came up three or four times, with some very different perspectives, including from one of the CEOs we heard from, and some on our investment team!

It was… willing.

Speaking of 1999, I've been here before.

No, I'm not saying Tesla is a bubble. At all.

What I am saying is that when people start to look for investment advice on Google, well, you know that not everyone is thinking rationally.

Worse, those who are (eventually) right will learn nothing from their experience, other than the false confidence from being right once. Those who lose? Well, if they don't go broke, they'll become dispirited and perhaps give the whole thing away.

Back in the sensible centre?

You need to be confident to pick stocks. After all, if you're going to beat the market, you have to find stocks you think the market is wrong about.

But we're back to 'strong opinions, weakly held'.

Want to hear a little secret? At Motley Fool Share Advisor, we're wrong quite a bit.

Funnily enough, you won't hear many (any?) others in my industry say that. Apparently it's bad for business.

Which is fine by us.

We don't exist to join the ranks of the arrogant and bloated (with your money, by the way).

The good news?

In our 8-plus year history, we've been right more than we're wrong.

And our average winner makes more than our average loser costs us.

The net result? We're beating the market.

I say that not to boast, by the way, but to show you a better way than arrogant, partisan 'death or glory' investing.

We're long-term investors at The Motley Fool.

And sometimes we have a member ask us, with not just a little feeling "I thought you guys were long term investors. Why are you selling after [X] months/years?"

The answer is usually a combination of:

"We got it wrong"

"Circumstances changed" and/or

"After a rise in share price, we no longer think it's likely market-beating"

Unspoken (usually!) of course, is John Maynard Keynes' line: "When the facts change, I change my mind. What do you do?"

Sure, we could hold on through bloody-mindedness.

But that's rarely a smart decision in any walk of life.

(For the record, that's different to short-term share price falls. We absolutely hold through market volatility, if our investment thesis remains on track.)

The only thing worse than being wrong is being too arrogant to admit it.

No, I'm not perfect. I held Coca-Cola Amatil for too long. And there are likely more — both past, present and future.

I'm not here to tell anyone they're wrong.

Or, to pretend I'm always right.

I'm here to remind you that 'certainty' is a liability when it comes to investors' views on particular companies.

Confidence, yes. But certainty, no.

Because when the facts change, as Keynes noted, we need to not be so dogmatic in our views that they're almost impossible to change.

That — in part — is one of the things I think has allowed us to beat the market so far at Motley Fool Share Advisor: a focus on the long term, and a preparedness to change our minds when we have a reason to.

Doesn't that sound like the best approach?

Fool on!