It's easy to look back on ASX shares that you had wish you owned – hindsight is a marvellous thing. However, if we try to learn from it and understand what made certain companies perform better than others, maybe, just maybe, we won't miss out on similar opportunities that are present on the ASX right now.

Below are 2 ASX healthcare companies I missed out on in 2019. Unfortunately, I left them sitting on my watch list, where they still remain today.

Medical Developments International Ltd (ASX: MVP)

Anyone in Australia who has had the misfortune of requiring an ambulance or been to the emergency room would probably have heard of the 'green whistle'. The green whistle administers the pain-relieving drug 'Penthrox', which is used by ambulances, the defence force, paramedics, life savers and medical practitioners. It is produced by Medical Developments and is superior to alternatives due to its fast acting, self-administered and non-addictive pain relief.

In 2019, Penthrox sales grew in Australia by 32%, and in Europe by 401% (with most major countries such as Germany, Italy and Spain still to launch). The company also boasts a pathway for potential approval in the huge US market, so it's no surprise the Medical Development's share price more than doubled in 2019, opening last year at $4.39 to hit a high of $9.24. The share price is currently sitting near its 52-week high, trading for $9.02 at the time of writing.

Nanosonics Ltd (ASX: NAN)

Another medical company with envious results throughout 2019 is the ultrasound disinfection device manufacturer Nanosonics. The Nanosonics share price took a huge leap in 2019, opening the year at just $2.80, hitting a recent high of $7.60 in November, and currently trades at $6.36.

This impressive performance followed on from a less impressive year in 2018, with the stock being one of the most shorted shares on the ASX – a position I'm sure short-sellers are regretting due to the subsequent share price gains.

Short-seller interest rose as Nanosonics traded on eye watering multiples, which were believed to be unjustified. However, thanks to the rapid adoption of its Trophon and second generation Trophon2 technology that provides an automated high-level disinfection solution for ultrasound probes, the company saw FY19 revenues rise 39% and profit before tax up 201% on the prior corresponding period.

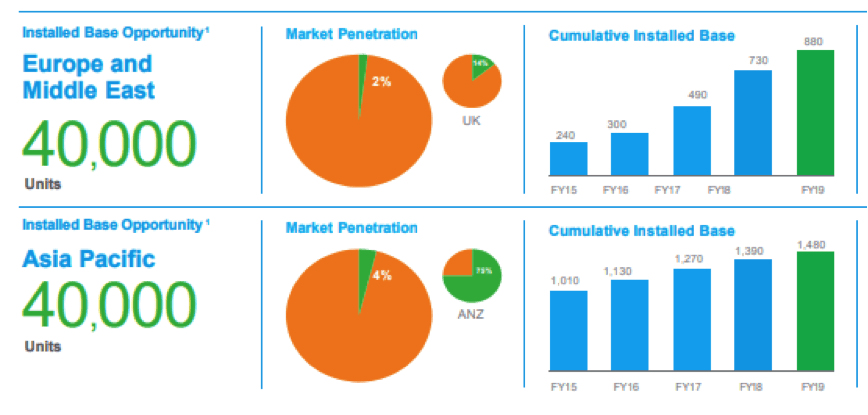

With the trophon2 gaining regulatory approval in Japan and new agreements in Europe, it appears Nanosonics still has significant growth potential. In fact, it stated that it currently only has a global market penetration of 17% with huge opportunities still present in Europe, the Middle East and Asia Pacific, as shown by the below graphic.

Foolish takeaway

Both Medical Developments and Nanosonics develop and offer a unique product to a huge addressable market. Both companies have expanded globally and are continuing to see huge growth, which could also make them both shares to outperform in 2020.