The PushPay Holdings Ltd (ASX: PPH) share price closed at $3.86 this Tuesday afternoon, which puts it up 18.77% in the past month.

Pushpay is a donor management system run through a smartphone app that allows non-profit organisations and education providers throughout the US, Canada, Australia and New Zealand to collect donations. The aim of PushPay is to simplify the payment and administration processes that is involved in taking donations. In essence, it is a virtual offertory basket – not to be confused with yet another buy-now, pay-later provider.

On 6 November, Pushpay released its interim report outlaying its growth and activity over past 6 months. The market took to the news well with an immediate 5% share price increase within the day and a 23% increase throughout the rest of November! So, why the re-rate? Let's dig deeper.

Growth reflected in financial data

Pushpay is in its growth stage within the lifecycle of a company. Its rapid expansion throughout the last 3 years has been continued into 2019, with its focus on de-risking last year reflected in the sound financial data from this interim report.

Firstly, Pushpay was able to increase total revenue by 30% in comparison to the prior 6 month period, a great start to the new financial year. This is especially impressive when considering that Pushpay's customer acquisitions grew at a lesser pace than the prior period.

Secondly, Pushpay was able to lower its operating costs relative to its revenue, or gross operating margin. An increase in gross operating margin from 57% to 65% was reported. When compared to the guidance of 63% set in the annual report earlier in the year, we can see that Pushpay is serious about its financial targets.

Thirdly, and arguably the most important metric is net profit after tax. Pushpay reported its first net profit ever on 6 November. This is huge. PushPay is now a growth company that has reached a point where it can sustain its business activities without capital raises and turn a profit also, making it one of a select few speculative growth opportunities that have reached this milestone.

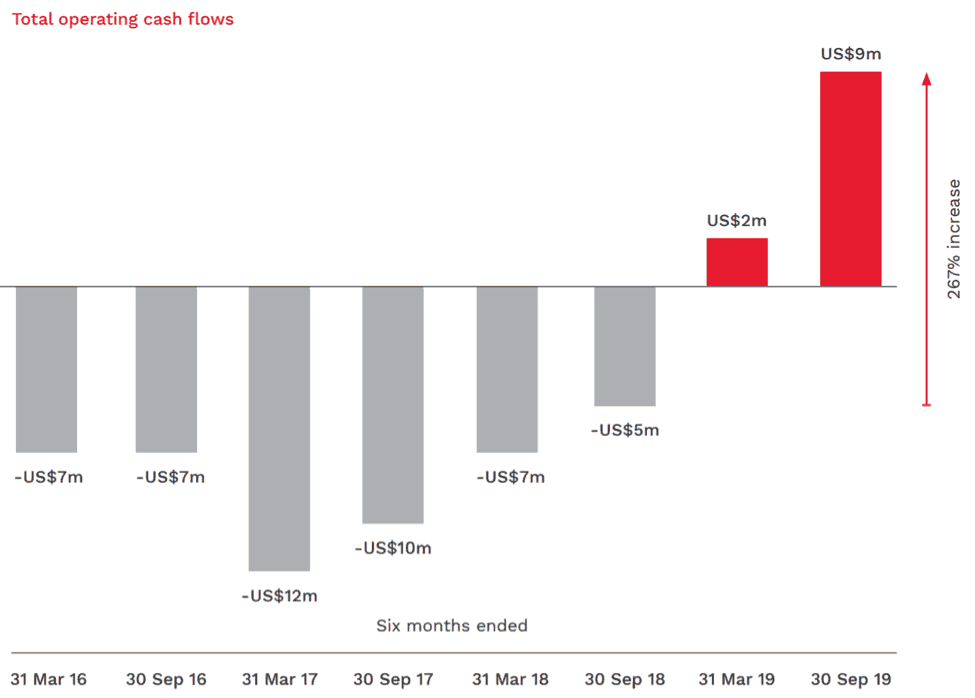

One last thing to note is Pushpay's total operating cash flow. For the second reporting period ever it is also break even, yet again showing that PushPay is able to cover its operating costs without further pesky capital raises.

Source: Pushpay Interim Report 2020

Future growth and added functionality

Okay, so what about Pushpay's future growth potential? What more can a virtual donations basket do?

Well, according to PushPay's interim report, it is bringing more functionality to its platform in order to increase customer engagement – a play that is seen everywhere throughout the ASX tech sector. More engagement means the customer is more likely to reuse the service/spend money with the service.

PushPay is introducing functionalities within the existing app that allows donors to connect with the outcome of their generosity. Basically, Twitter for your donations, where the tweeter is the organisation that you have donated to. Furthermore, PushPay has introduced media-based push notifications with related content that entices users to open the app. This has led to a 350% increase in open rates compared to text-only basic push notifications.

Perhaps the smartest play that PushPay has decided to conduct is PushPay University. This is a platform that sponsors leaders of spiritual groups across the globe to undergo PushPay's own leadership/donor development courses. Free of charge… only if you are a current PushPay user though. This is a very intelligent play, giving out free education on your own platform that encourages already inspiring people to inspire more people to engage with their cause and donate further. Genius!

Foolish takeaway

I think PushPay deserves every cent of its recent re-rate by the market. The financials speak for themselves. Most of the risky part of investing in any company is over for PushPay – it's a break-even operation that should require no further capital raises for cash flow purposes. The initiatives that PushPay is undertaking to increase customer engagement make sense for its business model. There is plenty of room for global expansion in the coming years, Europe is perhaps the biggest religious market that PushPay is not currently doing business in.

All in all, PushPay is a unique FinTech play that is worth a look for growth investors with a medium-risk appetite.