There are only 2 certainties in life: death and taxes. And since we can't invest in taxes, why not invest in death? It may sound a little morbid to some but it provides an indelible and increasing tail wind to the funeral industry.

One player in this industry is Propel Funeral Partners Ltd (ASX: PFP). Propel owns 120 funeral, crematorium and cemetery locations throughout both Australia and New Zealand.

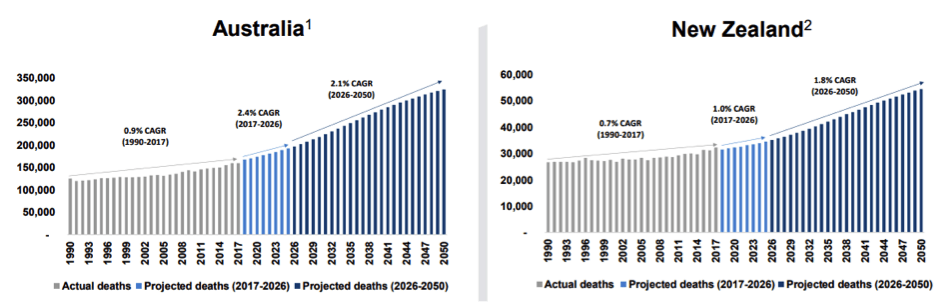

It's no secret that everyone dies. As the population increases, combined with an ageing demographic, the projected death rates both here in Australia and in New Zealand are expected to increase, as shown in the below graphic.

When you combine an increase in funeral volume along with an increase in average revenue per funeral (ARPF) of 2.8% and a growth by acquisition strategy, you get a compounding effect which has seen the company's revenue increase by 17.6% over the past year.

In fact, Propel added 17 new locations in FY19 and looks to continue this expansion, as indicated by Independent chairman Brian Scullin, who stated that "Propel remains focussed on a clearly defined investment strategy to acquire infrastructure and assets which operate within the death care industry in Australia and New Zealand."

This strategy appears to be working too, as the company noted in its last financial report that it has increased its market share from ~1.2% to ~5.6% since 2015. This growth appears to have partially come at the expense of larger rival InvoCare Limited (ASX: IVC), which has lost 1.6% in the same timeframe to sit at ~23%.

To fund these expansions, Propel has been drawing on its existing debt facility, which it has recently increased to $150 million. This leaves it with around $70 million to continue its strategy. At a time when cash is cheap as long as they remain within their covenants, I believe this should help accelerate their growth.

Death volumes are, however, seasonal and the charts only show actuarial predictions which, in reality, are lumpier due to bad flu seasons and heat waves etc. However, we are currently seeing funeral volumes reverting back to long-term trends.

I believe Propel is perfectly placed to continue gaining market share and grow its revenue over the long term. In fact, it has already stated that the first quarter of 2020 is materially above the prior corresponding period by 19% mainly due to a recovery in death volumes, and since this business has largely a fixed cost base an increase in volumes should also see better margins.

Foolish takeaway

With an adjusted price-to-earnings ratio of nearly 24, I believe a lot of this growth is probably already baked into the Propel Funeral share price. However, due to its defensive earnings, a patient buy-and-hold investor could dip their toes in and look to increase their position if any further price fluctuations present themselves.