In morning trade the Harvey Norman Holdings Limited (ASX: HVN) share price has edged lower.

At the time of writing the retailer's shares are down slightly to $4.31.

Why is the Harvey Norman share price heading lower?

Ahead of its annual general meeting in Sydney, Harvey Norman released a sales update.

According to the release, the aggregated sales from wholly-owned company-operated stores and from independent Harvey Norman, Domayne, and Joyce Mayne branded franchised complexes totalled $2.44 billion for the period July 1 to October 31.

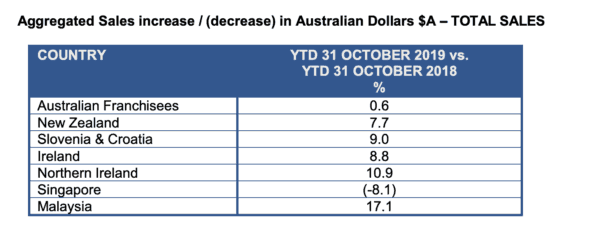

This was an increase of 2% on the aggregated sales generated in the prior corresponding period. Comparable aggregated sales for the period increased by 1.7%.

Some of this gain is attributable to favourable currency movements. The British pound, Euro, Singaporean dollar, Malaysian Ringgit, and New Zealand dollar all strengthened against the Australian dollar.

A summary of how its businesses performed during the period can be seen on the table below:

What else happened at the annual general meeting?

Harvey Norman provided shareholders with a reminder of how it performed in FY 2019.

It delivered an 8.8% increase in reported profit before tax to $574.56 million, a 4.5% increase in earnings per share to 34.7 cents, and declared a 33 cents per share dividend.

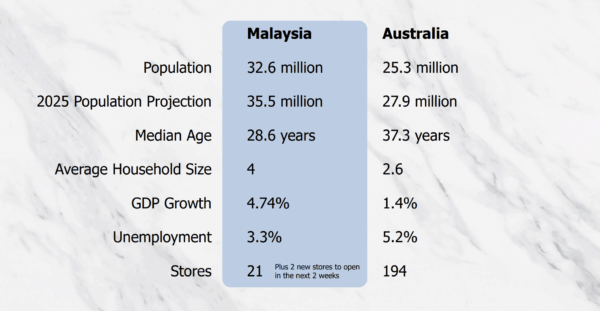

It also noted that 23% of its profit before tax is now generated overseas. This looks set to continue growing in the coming years, with management seeing a major opportunity in the Malaysia market.

As you can see above, Malaysia appears to be a market which has the potential to cater to a much larger number of Harvey Norman stores compared to where it stands now.

This could be a key driver of growth in the future, helping to offset a potential slowdown in growth in the increasingly saturated Australian market.

Elsewhere on the market today, the JB Hi-Fi Limited (ASX: JBH) share price is trading slightly lower, potentially in response to this update.