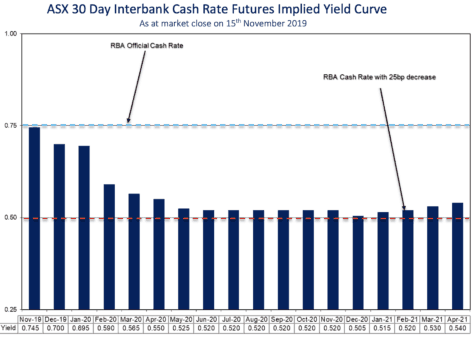

According to current cash rate futures, the market is currently pricing in one further cash rate cut by the Reserve bank.

As you can see on the chart below, this is expected to be made in the middle of next year.

Unfortunately, this is likely to mean that interest rates will remain at ultra-low levels for some time to come.

Luckily, the Australian share market is home to a large number of shares offering generous dividend yields that can help you beat the cuts. Three that I would buy today are listed below:

BHP Group Ltd (ASX: BHP)

If you don't mind investing in mining shares then I would suggest you consider BHP. It has rewarded its shareholders with big dividends in 2019. This has been achieved thanks to a combination of asset sales, favourable commodity prices, and ultimately bumper free cash flows. Pleasingly, I believe it remains well-positioned to repeat this in FY 2020 and estimate that its shares currently offer a fully franked forward 6% dividend yield.

National Australia Bank Ltd (ASX: NAB)

The banking sector has come under pressure this month following a series of underwhelming results. However, I would suggest income investors take advantage of this weakness and pick up shares. Especially given their generous dividend yields. One of my favourites in the sector is NAB due to its strong underlying performance and its positive outlook. The latter is due to its overweight exposure to SME lending. NAB's shares currently offer a trailing 6% fully franked dividend yield.

Super Retail Group Ltd (ASX: SUL)

A final option to consider is Super Retail. It is the retail group behind chains including BCF, Macpac, Rebel, and Super Cheap Auto. Despite the tough trading conditions in the retail sector, Super Retail has started FY 2020 in a positive fashion. In light of this, I remain confident it will deliver modest earnings and dividend growth this year. As a result, I estimate that its shares offer a forward fully franked 5.2% dividend yield.