In morning trade the News Corp (ASX: NWS) share price has tumbled lower following the release of its first quarter update.

At the time of writing the media giant's shares are down 3% to $19.81.

How did News Corp perform in the first quarter?

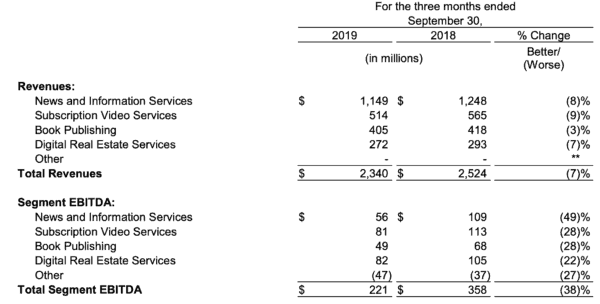

During the three months ended September 30, News Corp reported revenues of US$2.34 billion. This was a 7% decline on the prior corresponding period.

This softer result reflects the negative impact from currency headwinds and the absence of a one-time benefit in the prior year following the exit from its gaming partnership with Tabcorp Holdings Limited (ASX: TAH) for Sun Bets.

Lower subscription revenues at Foxtel and weaker revenues from REA Group Limited (ASX: REA) also contributed to the decline.

On the bottom line the company posted a net loss of US$211 million. This compares to a profit of US$128 million a year earlier and is due to non-cash impairment charges of US$273 million. These impairment charges relate primarily to its News America Marketing business.

On the chart below you can see a breakdown of how its various segments performed.

Management commentary.

Chief Executive Robert Thomson explained: "In the first quarter of Fiscal Year 2020, News Corp showed strong growth at Dow Jones and higher revenues at Move, the operator of realtor.com, but the results were affected by pronounced currency headwinds, a particularly sluggish Australian economy and property market, and comparisons with a prior year in which there was a significant one-time revenue item."

Mr Thomson appears optimistic on the future, especially given recent industry trends.

"We are pleased to note tangible progress in our efforts to secure payment for our high-quality content from digital platforms, a global cause which News Corp has led for more than a decade. With the dominant platforms under intense regulatory scrutiny, there has been a fundamental shift in the content landscape, highlighted by Facebook's decision to pay a significant premium for our premium journalism. This development establishes a precedent that changes the terms of trade and we expect a positive financial impact at our News and Information Services segment, beginning this fiscal year," he added.

He also spoke positively about News Corp's focus on simplifying the business.

He said: "Our efforts to simplify the company continue apace. We are in active discussions about a sale of News America Marketing and also are reviewing the potential sale of Unruly. We are taking steps to reduce our sum of the parts discount, while investing in our digital businesses, to the benefit of all shareholders."