The Lovisa Holdings Ltd (ASX: LOV) share price is up around 500% over just the past 5 years but the jewellery retailer remains under-the-radar of many investors. Over FY 2019 it grew net profit 3% to $37 million on revenue growth of 15.3% to $250.3 million.

It also paid 15 cents per share in fully franked dividends on earnings of 35.1 cents per share.

The result and outlook impressed Morgans' analysts enough for them to slap a $13.66 'share price target' on the business that leaves room for a little upside yet.

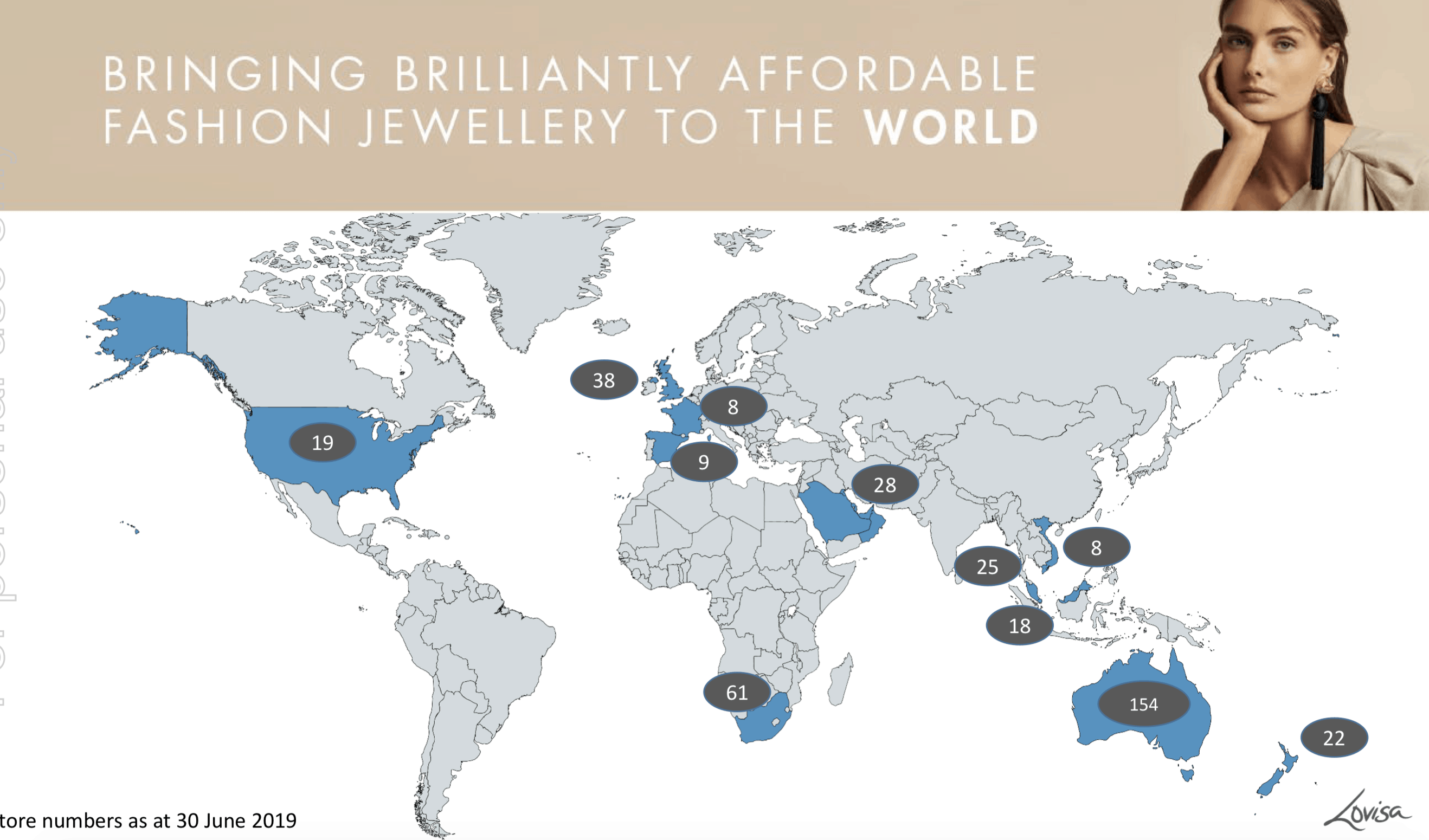

Powering the growth has been an aggressive global store roll out strategy as it opened a net 64 new stores over fiscal 2019 to take the global total to 390. At its AGM today it flagged another 31 net new store openings over fiscal 2020 to take the total to 421. In the U.S. it now has 33 stores operating across 5 states with plans to ramp up expansion.

Source: Lovisa presentation store number chart at June 30, 2019.

The new store openings naturally lift total sales, but that doesn't mean much if the sales are not profitable with a better metric to consider for retailers being same-store sales growth.

Today it reported that same-store sales for the first 17 weeks of FY 2020 are up 2.3% which is a respectable result. Fiscal 2019 actually saw comparable sales fall 0.5% in a result that put a handbrake on the vertiginous share price.

The balance sheet is in reasonable shape with a net cash position of $11.2 million as at the financial year end.

Lovisa also has retail entrepreneur Brett Blundy on its board who is also a big backer of footwear retailer Accent Group Ltd (ASX: AX1).

The other strong retailers on the local market are heavily owned by rival retail entrepreneur Solomon Lew. Those being Breville Group Ltd (ASX: BRG) and Premier Investments Limited (ASX: PMV).

Lovisa might be a decent quality retailer, but shares on around 35x trailing earnings look pricey to me. Especially compared to Accent Group on just over 15x trailing earnings with a much bigger dividend to boot.