The WiseTech Global Ltd (ASX: WTC) share price will be one to watch on Monday after the logistics solution company responded to a scathing short seller attack.

In case you missed it, on Thursday J Capital released a report claiming that WiseTech is overstating its profits.

The short seller alleges that "overstated profit in the three years since WiseTech listed may be as high as $116 mln. That would be an overstatement of 178%." It also alleges that the company is overstating its organic growth and has doubts over its European business.

What was WiseTech's response?

After the market closed on Friday WiseTech responded to the short seller report.

WiseTech stated that it rejects entirely the allegations of financial impropriety and irregularity and notes that J Capital did not contact it ahead of publishing.

The company's founder and CEO, Richard White, said "We are very concerned that the allegations in the document may mislead and manipulate the market to the detriment of WiseTech's business and its shareholders, large and small. Our financials, our revenue, our profit, our growth rates and our product have all been verified comprehensively and form part of the external independent audits conducted annually."

The rebuttal.

The company then provided a thorough rebuttal to all of J Capital's key claims.

WiseTech advised that there has been no overstatement of profit, growth or revenue. Its accounts are accurate and not inflated through acquisition accounting.

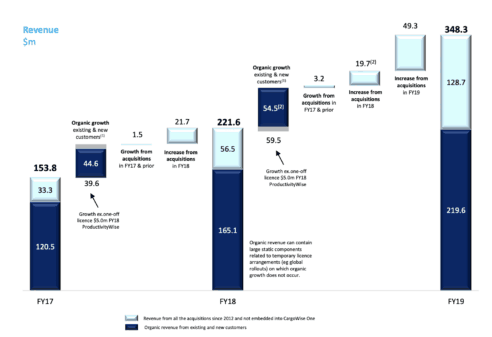

"The JCAP commentary appears to suggest the information on organic growth and acquisition revenues is unclear, in fact WTC disclosures provide the split of revenue between organic and acquired for FY17 to FY19 and articulate the drivers for organic revenue growth which support our indicated average organic growth range of 20%-30% pa, see p47 and 48 of the FY19 Investor Briefing Materials."

This can be seen on the chart below:

Further, J Capital alleges that WiseTech is capitalising the costs of software asset development to inflate assets and therefore exaggerate profit and revenue.

"We are a technology company, the assets we build are software. WiseTech has consistently applied the requirements of the applicable Australian Accounting Standard (AASB 138), and in compliance with International Financial Reporting Standards (IFRS), which requires the capitalisation of eligible costs. As required under IFRS we capitalise our investment in internally developed new software components which can be commercialised. We also appropriately expense much of our software effort including maintenance, bug fixes and software investments not likely to be commercialised."

WiseTech then hit back at claims that it is overstating its European/EMEA revenues.

"Our revenue by geographic location and the Financial Statements clearly state that it is based on our customer's invoicing location, based on billing address. This approach was adopted in FY16 as the billing model for the business was largely centralised in corporate headquarters in Australia, thus regional centres, including the UK, became support centres. Internal revenues are eliminated in the group consolidation, as is required by accounting standards."

This is important as it means some of its largest global customers, such as DHL, DSV, Geodis, Bollore, and Rohlig, are included in EMEA revenue as they are headquartered in the EMEA region.

Management then explained that its pre-IPO accounting was not unusual, that its audit was comprehensive, and that the deed of cross guarantee was irrelevant.

CEO Richard White concluded: "We acknowledge the right to differing opinions, but we are deeply concerned about the extensive value destruction that can be wrought from short seller reports that potentially damage our shareholders large and small and the integrity of investment markets. All shareholders should be aware that unconscionable attempts to manipulate the market exist and may continue. We thank our shareholders for their support and patience while we correct these erroneous reports."

Mr White then suggested that regulators crack down on the practice.

"Whilst we, and other Australian listed corporations, are subject to stringent external audit, validation and verification, no such standard applies to these types of actors. Many of these attacks may largely be beyond the reach of our market regulators and operate in ways that are clearly at odds with our system of laws, our market, culture and society. We support investigations by regulators of attempts by short sellers to target ASX companies and in prosecuting unconscionable conduct," he added.

I'm sure the likes of Corporate Travel Management Ltd (ASX: CTD) and Rural Funds Group (ASX: RFF) would support this view.