The Rural Funds Group (ASX: RFF) share price is flat at $1.77 today even after the agricultural REIT launched a defence of its asset (farmland) valuation methods and calculation of the funds from operations it earns to pay dividends.

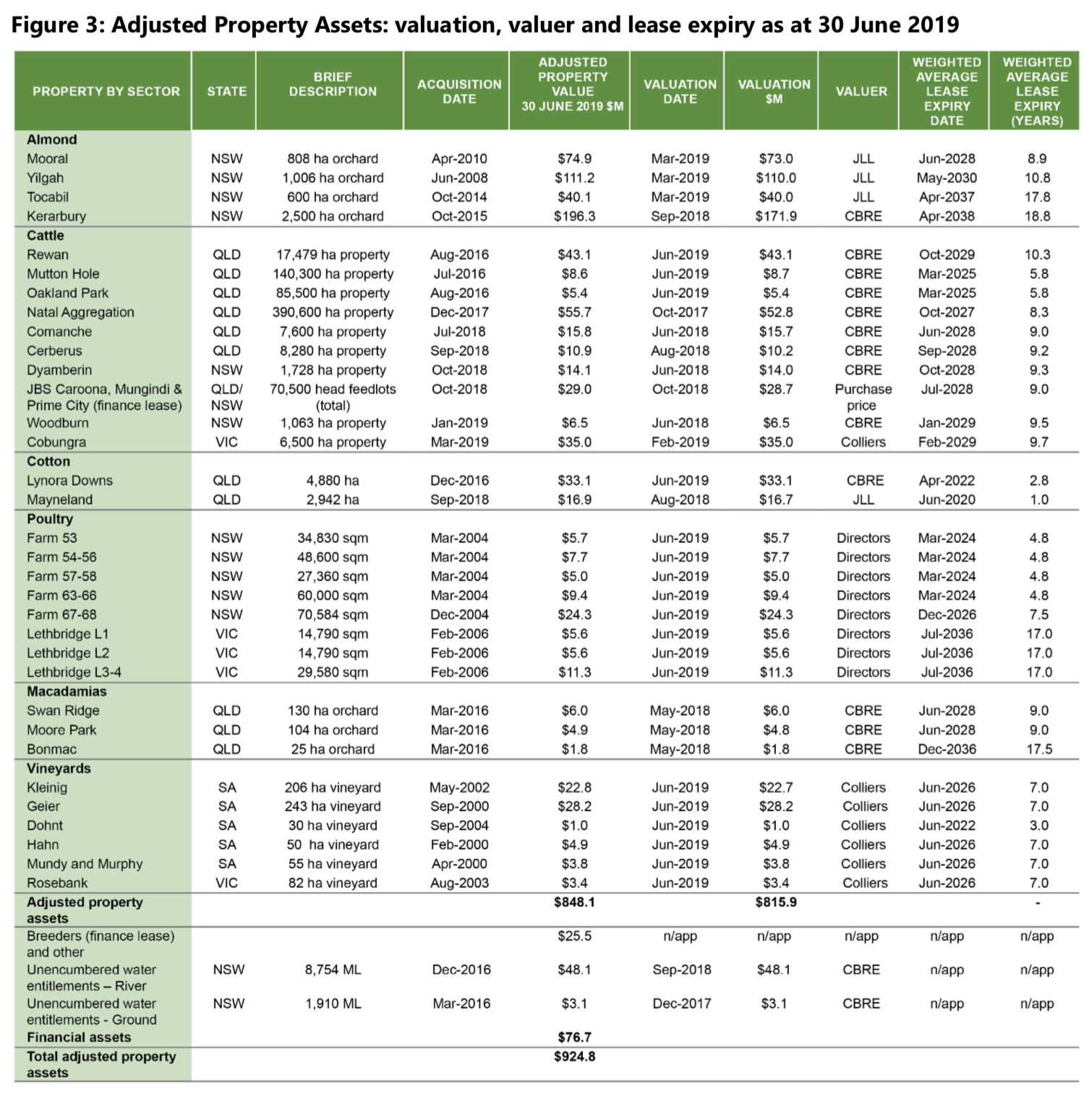

Rural Funds has recently been the target of two short seller reports from Bonitas Research and Bucephalus that both accused it of inflating asset valuations to boost fees earned by its related management company RFM.

The short sellers also alleged the remuneration structure was conflicted or dubious being on the basis of asset valuations rather than net income for example.

However, today RFF provided a granular rebuttal of the allegations including the below chart that shows how it reached the valuations of its assets as at June 30 2019.

Source: Rural Funds presentation, October 9, 2019.

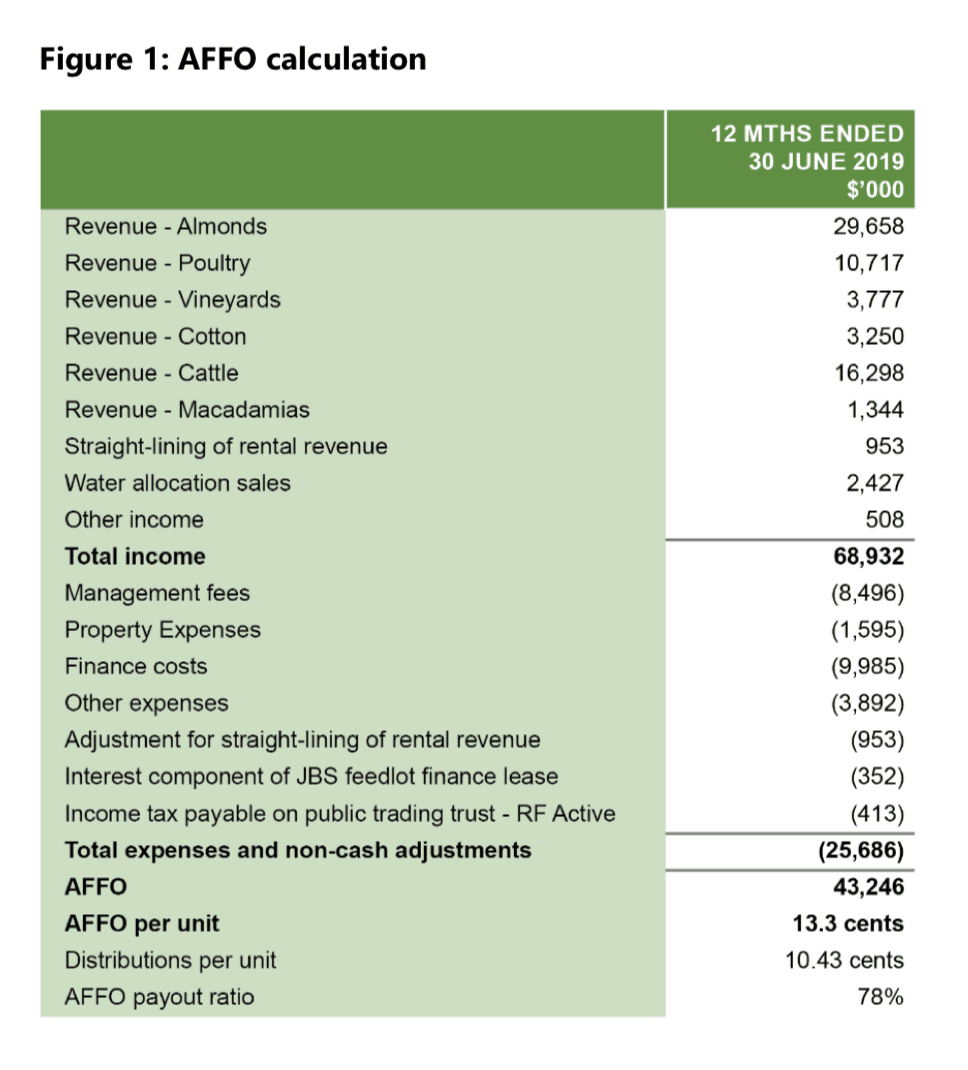

Bucephalus also alleged its research showed that Rural Funds' free cash flows or adjusted funds from operations (AFFO) were lower than its total dividend payouts and in effect being subsided by debt and capital raisings in a Ponzi-scheme type operation.

Rural Funds has repeatedly dismissed these allegations and provided the below chart showing how its AFFO more than covered dividend payments for the 12 months to June 30 2019.

Source: Rural Funds presentation, October 9, 2019.

Source: Rural Funds presentation, October 9, 2019.

For now Rural Funds remains in a a public relations battle with two short sellers who are not backing down.

As can be seen from the middling stock price different investors are also drawing different conclusions over the business structure.

Other businesses facing down heavy short seller interest include NextDc Ltd (ASX: NXT) and Metcash Limited (ASX: MTS).