A lot of retail investors will be stepping up their search for yield given 0.75% cash rates with Sydney-based Metrics Credit Partners now running two listed investment trusts on the ASX that provide the opportunity to lock in some term-deposit-thumping yields.

The MCP Income Opportunities Trust (ASX: MOT) and MCP Master Income Trust (ASX: MXT) are both exchange traded listed investment trusts that aim to return between 4%-10% per annum to investors, with capital preservation a priority.

Zooming out a little, Metrics Credit Partners describes itself as Australia's leading non-bank corporate lender mainly involved in the asset finance, working capital, general capex, or acquisition funding space.

Typically it'll lend in the healthcare, real estate, leisure, private equity, and PPP space to effectively give fund investors access to the higher returns available in private debt markets.

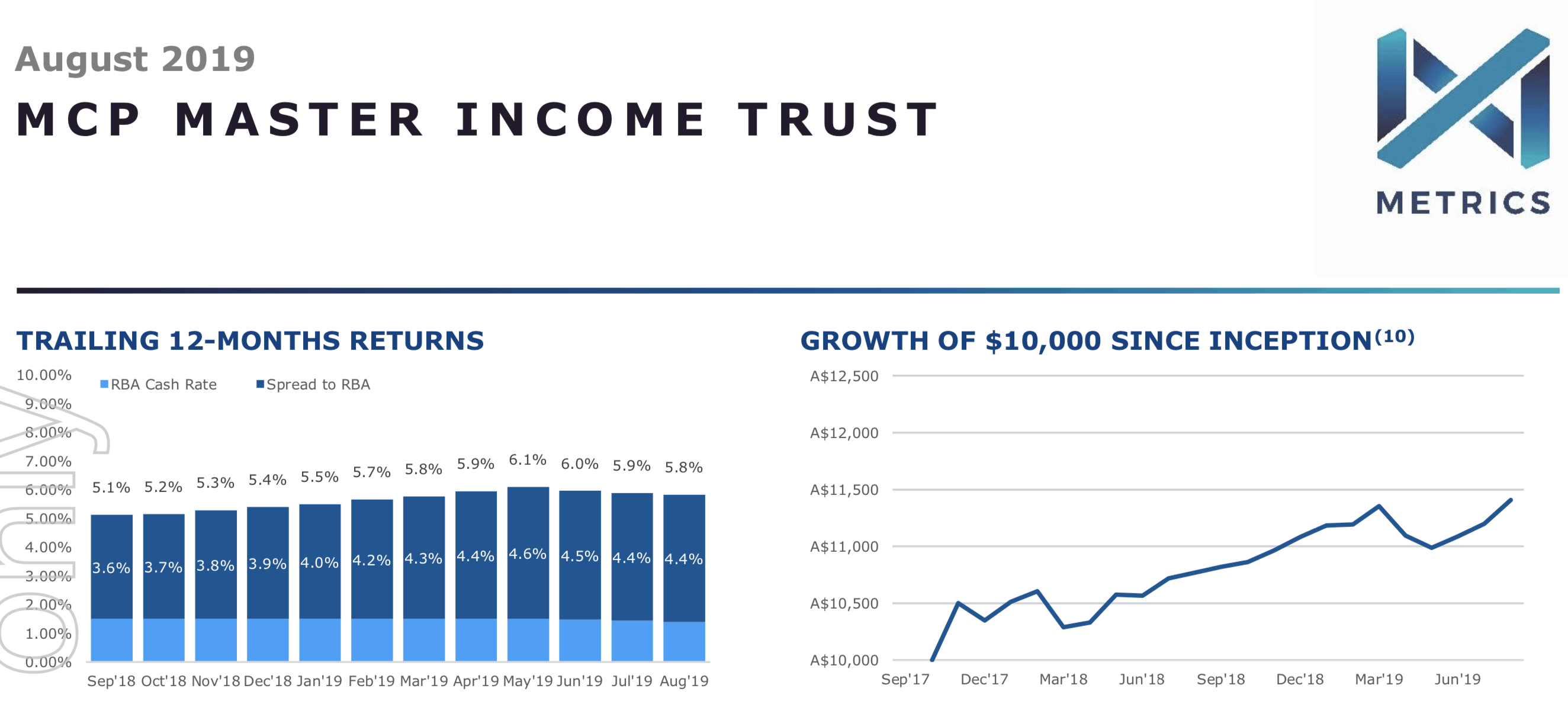

The MCP Master Income Trust targets returns of 3.25% above the RBA cash rate (net of fees and costs) and pays income monthly, while yielding 5.8% as at August 2019. The chart below gives investors a good idea of past performance.

Source: Metrics Credit Partners presentation, Sep 12, 2019.

The fund itself appears reasonably liquid with at least a couple of million dollars worth of units being traded daily according to Commsec, and the management team reports it's keenly aware of managing issues around the liquidity of the underlying assets.

In April 2019 the MCP Income Opportunities Trust (ASX: MOT) started trading on the local market after raising $300 million at IPO. It aims to return 8% to 10% per year to investors net of fees, while preserving capital and offering potential to benefit from any upside gains on alternative investments.

The company is run by a coterie of highly experienced investment partners with long career histories working at major international or Australian banks such as National Australia Bank Ltd (ASX: NAB). The average partner has between 30 to 40 years' investment experience.

Interested investors can get in touch with the company directly via its website and read up on all the relevant product disclosures online. If necessary they should also seek professional advice before any investment.