Nearmap provides high resolution aerial imaging to range of customers and subscribers around the world. Many analysts have written and spoken about Nearmap's high growth story, which is highlighted by recommendations by my fellow Foolish contributors here.

Potential investors will be hoping that they haven't missed the boat on Nearmap and would be looking for clues that point to continued growth.

So, where is that growth likely to come from?

Nearmap provided some insight into future plans at its FY19 presentation back in August. Let's take a closer look.

Global growth

Increasing Nearmap's global footprint is one of the keys to unlocking its enormous potential growth. According to Geobuiz, the global market for aerial imaging services was estimated to be $7.4 billion in 2018 with an anticipated market of $10.1 billion by 2020.

Nearmap has outlined several strategies to propel sales and subscriptions and gain its share of this predicted market growth. Several marketing strategies were outlined at the recent presentation including increasing sales and marketing investment in the North American market to accelerate growth.

In addition, Nearmap is undertaking to improve brand awareness with several targeted campaigns in the pipeline. Further, Nearmap intends to invest in automation and analytics to bolster upselling and identify new customers. Lastly, the company is committed to remaining vigilant for new global opportunities and evaluating its potential.

New and improving products

Keeping ahead of the technology curve and providing industry leading applications is another road to growth. Nearmap is looking to expand its rollout of the HyperCamera2, which can offer greater coverage and premium content.

Nearmap has touted several technological improvements in the pipeline – some will provide subscribers with more tools to analyse web-based images, whilst others will improve and accelerate 3D capabilities.

Happy customers

The key to running a successful business on a subscription model is satisfied customers. Subscription based industries like the arts, publishing and in this case, high resolution aerial photography, know that without high level customer support and engagement those "one year" subscriptions can very quickly become "one off" subscriptions.

Nearmap has managed to reduce churn to 5.3% in FY19. "Churn" is a way of measuring subscriptions not renewed offset by recovered or new subscriptions. The reduction in this figure highlights improving retention rates amongst existing subscribers.

Understanding the vital importance of customer retention, Nearmap had undertaken to deepen customer engagement going forward. Strategies have been built around greater investment in customer success and stronger engagement with key accounts. Nearmap will also use available technologies to harvest new customers and to assist in engaging with a large customer base and eventual customer retention.

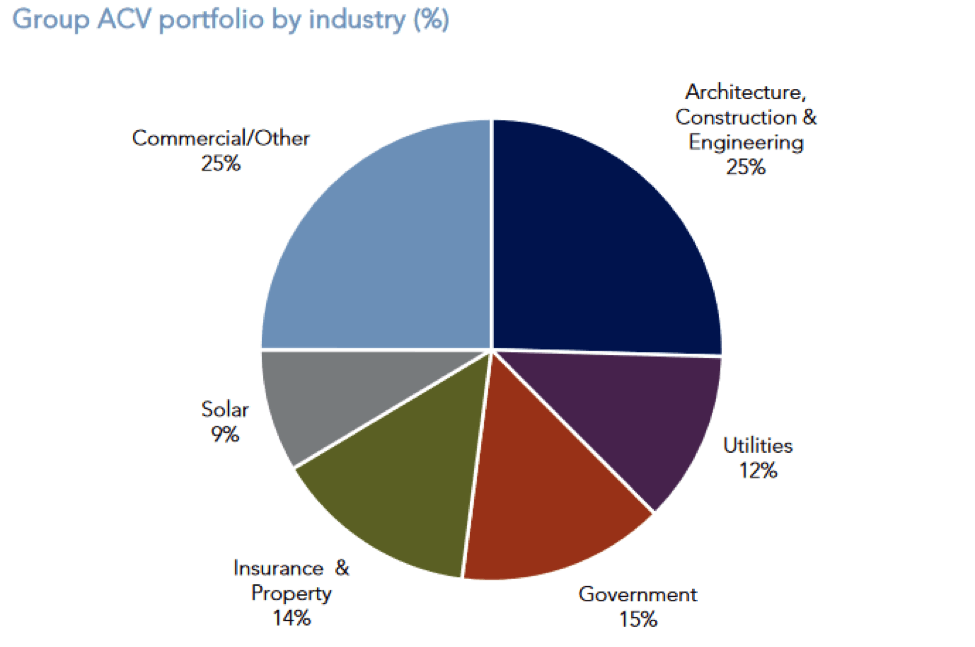

The above strategies should provide potential Nearmap investors with plenty of food for thought. However, one aspect of Nearmap's business that I've always found impressive is the diversity of its customer base. The chart below highlights the different industry groups that Nearmap's customers belong to. It also highlights 6 industry sectors prime for Nearmap to unlock future growth.

If you're inclined to invest, the Nearmap share price is currently trading for $2.58. That price is 39% less than the 19 June record high of $4.23, and yet Nearmap can still boast a 46% increase in share value over 52 weeks. With the price currently at the lower end, it may be a good time to buy.