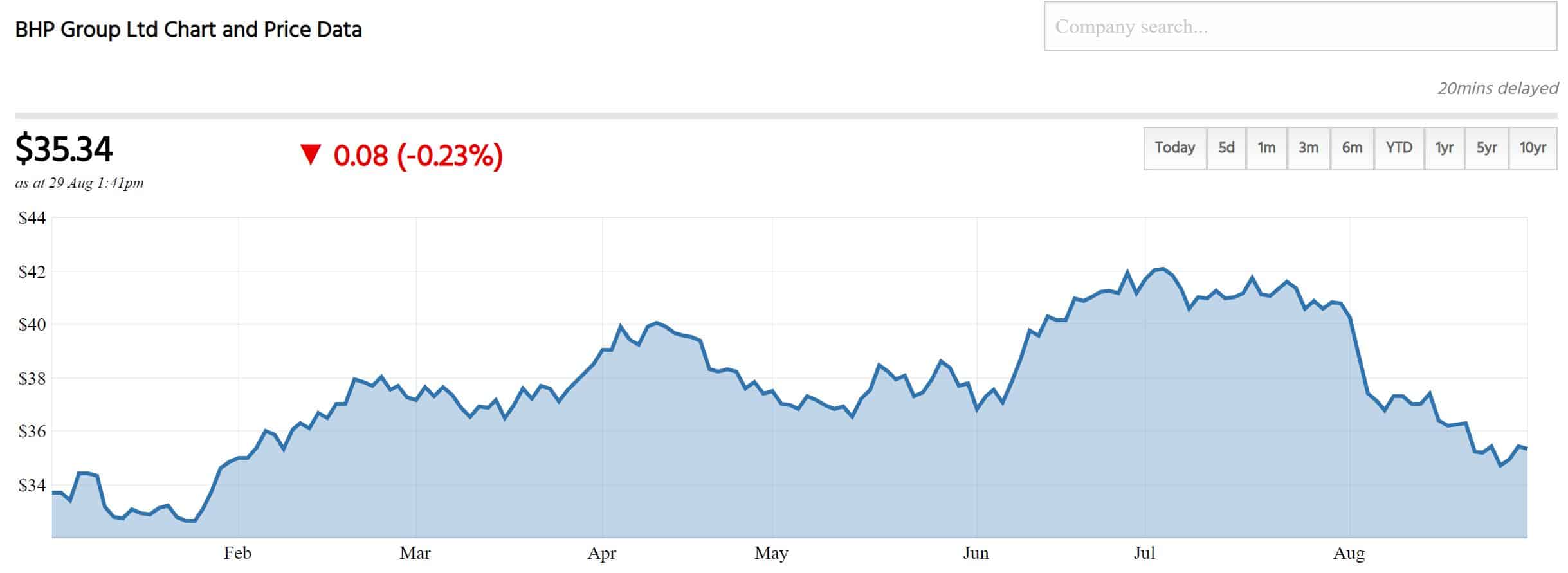

The BHP Group Ltd (ASX: BHP) share price has had a nasty month in August, with BHP shares falling from $40.76 at the end of July to the share price of $35.34 we see today (at the time of writing).

Its been a very interesting 2019 so far for BHP shares, with a graph of the YTD share price looking somewhat like a double speed bump.

We saw massive appreciation from January all the way up to July as investors piled into BHP stock on the back of a huge bull-run in the price of iron ore. However, the tide turned around this time and now BHP shares are back to the levels we saw in February.

What's happened with BHP in 2019?

Well, its all about that iron price. Being a mining company, BHP's share price typically tracks the price of its biggest commodity. Unlike arch-rivals Rio Tinto Ltd (ASX: RIO) and Fortescue Metals Group Ltd (ASX: FMG), BHP isn't a one-trick pony, with substantial exposure to oil, coal and copper – but iron ore still makes up the lion's share of BHP's earnings (nearly 40%).

Early this year, a dam owned by Brazilian mining giant Vale SA collapsed, resulting in the entire mine being shuttered. This caused an immediate supply squeeze in the iron ore market – resulting in the price of iron ore climbing from around US$70 a tonne to over US$120 a tonne in July – also explaining the run-up in BHP's shares during this time. But what goes up must come down and iron ore is trading for around US$82 a tonne today (resulting in BHP's shares being squeezed this month).

Is BHP a buy today?

As mentioned earlier, the BHP share price has now fallen 15% in August and now sits closer to the 52-week low ($30.31) than the 52-week high ($42.33). However, I still don't think BHP shares are a screaming buy right now. Although BHP is paying out record dividends this year, I think the shares are decidedly in a 'mid-cycle'- phase and further moves down in the short to medium-term are more likely than not.

The time to buy resources stocks is when commodity prices are at or near record lows and today, this is not the case. To put this into some perspective, in 2016 you could pick up BHP shares for under $16. That would have been a great time to strike, but I don't see today's prices of around $35 as a fabulous entry point.