If you're a new investor, Premier Investments Limited (ASX: PMV) is a company that you might not have heard of. Peek behind the name and you'll find a treasure trove of famous and successful Australian retail brands, including women's fashion outlets like Portman's, Dotti and Jaqui E. There's also unisex fashion staples like Just Jeans and Jay Jays. These brands will be familiar to most people who frequent most major shopping hubs around the country.

In addition, there are two more stars of the group including sleepwear designer Peter Alexander and the potential superstar children's stationery supplier, Smiggle.

Peter Alexander

Peter Alexander is one of the great success stories of the Australian fashion industry. The popularity of the highly sought-after range of high-end sleepwear has endured for more than 30 years and is highlighted by the existence of over 100 outlets in Australia and New Zealand.

At the most recent investor presentation in March, the Peter Alexander brand had achieved record 1H19 sales up 14.1% to $130.4 million. New stores are opening or in the pipeline and online sales were performing beyond expectations.

Smiggle

It's difficult to convey just how beautifully designed and built for purpose the Smiggle outlets are. The shops are small, but as you enter, you'll be greeted by an explosion of colour. Inside, you'll find every nook and cranny packed with beautifully designed and presented stationery. On its website, Smiggle suggests that you "come on in, experiment, explore, poke, prod and play, because a visit to our stores is just like a hug from your best friend. Where a smile meets a giggle, it's the world's greatest place."

It's easy to see why kids are so drawn to the Smiggle brand and as investors, we can see the global potential that it exudes. To highlight this, Smiggle announced it had opened 10 new stand-alone or concession stores in the 1H FY19 throughout South East Asia, the UK and Australia. The Asian component is a standout as sales have grown a remarkable 112% in just two years.

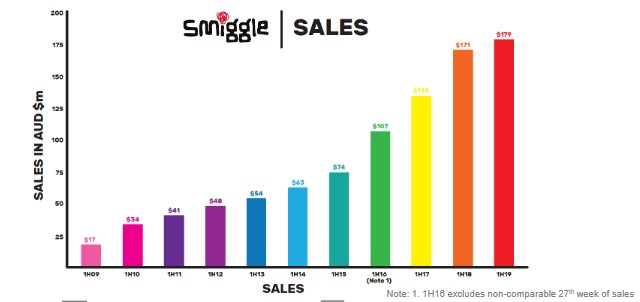

The chart below illustrates Smiggle's overall sales trajectory since 2009.

Like Peter Alexander, Smiggle is kicking goals online with online revenue margins higher than the brand average. A major deal with Amazon to distribute to the European market in the 2H FY19 will expose the brand to a market of 250 million people and significant plans are underway to take Smiggle to the world. Additionally, costs appear tightly managed with unprofitable stores closed and better locations and rental agreements sought.

Foolish takeaway

Like the rest of the ASX, the Premier Investments share price has ridden the roller coaster of the past few weeks. The share price opened today at $14.62, which is 24% lower than the record high at the same time last year. Despite this, and even considering Australia's static retail sales data, there are signs of short to medium term growth. And investors can also look forward to a grossed-up dividend yield of 6.31%.

Ideally, Premier Investments is one for the long-term investment portfolio and today's price might be the right time to get on board. Conservative investors may choose to wait and see. At the very least, it's one for the watch list.