The Accent Group Ltd (ASX: AX1) share price is up 9% to $1.62 this morning after the footwear retailer and wholesaler reported a net profit up 22.5% to $53.9 million on sales up 8.7% to $935.3 million for fiscal year 2019.

Over the year total dividends climbed 22% to 8.25 cents per share (plus full franking) on 10.03 in earnings per share on an 82% payout ratio.

The group has $36.7 million cash on hand and current or longer-term bank-equivalent debt of $86.1 million to mean the balance sheet is in 'ok' shape.

I've written regularly over the past few years why I think the company is a decent bet for fully franked income seekers and own shares in the business myself, even buying some more at lower prices earlier in 2019.

At $1.62 on a trailing basis it offers a yield of 5.1%, with the stock due to go without the rights to its final 3.75 cents per share dividend payment on September 15.

Like-for-like sales growth for the start of FY 2020 is up 2.7% and the group has plans to open 4o new stores over FY 2020 in addition to getting a full run through rate from 54 stores opened over FY 2019.

Margins are expected to remain broadly in line with the prior year.

Retail conditions were soft in FY 2019 and it's probably fair to assume they'll remain similar in FY 2020.

Overall though Accent Group has a habit of under promising and over delivering with guidance so it could deliver EBITDA or profit growth in mid-high single or double digits again in FY 2020. Existing guidance is for plain 'profit growth'.

If we assume it can lift earnings per share 0.5 cent or 5% in FY 2020 it's likely the dividend will come in around 8.75 cents per share plus full franking over FY 2020 to put it on a forward yield of 5.4% plus franking.

However, today's buyers could potentially pick up three dividend payments in a little over 12 months for a yield around 7.7% plus franking.

I'm focusing on yield in this article as I primarily view Accent as an income play. although at 16x FY 2019's earnings and posting double-digit growth with a potential 5.4% forward yield we can see it's arguably 'good value' as well.

That's before I get to its second-to-none track record of earnings per share growth.

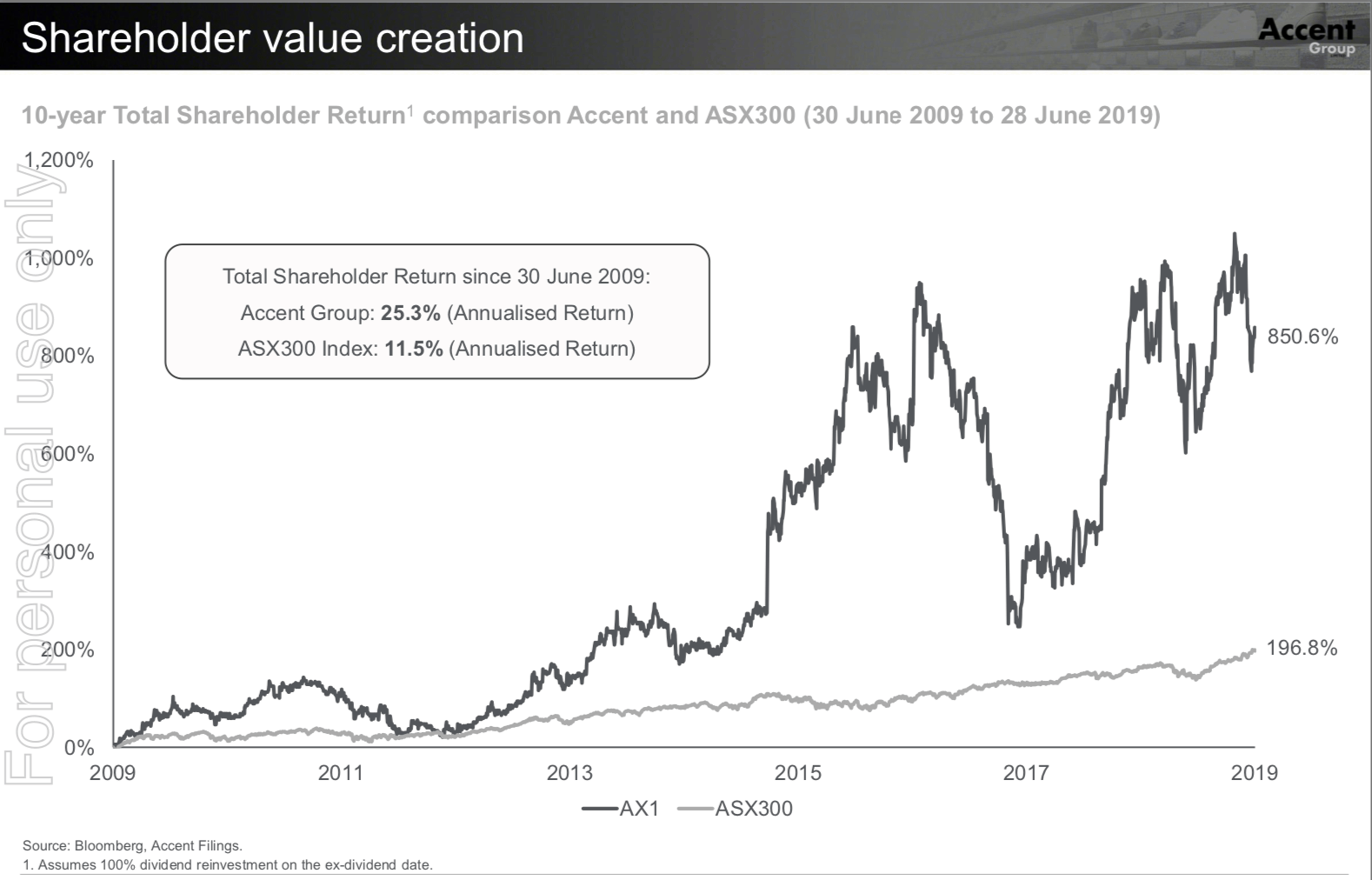

Take a look at the chart below on Accent's track record of delivering a 25.3% annualised return since 2009 assuming you'd reinvested dividends.

Source: Accent Group presentation, August 24, 2019

Of course past performance is no guide to future returns in the share market, but it can be instructive to show us what businesses are well managed and genuinely aligned to shareholder returns.

Notably the big valuation dip over 2016/17 was largely due to poor sentiment on media headlines around the arrival of Amazon.com in Australia as analysts also marked down the business on Amazon paranoia.

As it turned out Amazon has made little progress selling shoes in Australia.

Accent also just grew online sales 93% in FY 2019 and matches Amazon's same-day delivery with a much wider choice and closeness to youth fashion trends alongside popular brands only it can sell under licensing agreements.

The entrepreneurial retailer also has plans to open up to 40 new Trybe kiddies shoe stores over time.

An FY 2019 deal to buy trendy millennial sneaker store Subtype has also gone largely under the radar, but now provides it more potential to open new stores while selling high-end sneakers at high-end margins.

It also plans to open new PIVOT branded sport and street wear stores in H2 FY 2020, but didn't provide much detail on this plan and I missed today's earnings call. However, I have a feeling this may be part of a long term strategy to replace underperforming store brands with a new one.

It's also worth noting that everyone needs shoes at the end of the day to mean demand is less discretionary than for other apparel retailers.

Accent Group also appears to have a pretty dominant market position in high-street footwear retailers via its Hype, Platypus, Skechers and Athlete's Foot stores for example.

While the reasonable valuation is also likely to mean the share price downside is limited compared to sexy growth stocks like Altium Limited (ASX: ALU) or Pro Medicus (ASX: PME) in the event of a general share market downturn.

In fact if Accent shares get cheaper the yield gets bigger and I'd be inclined to buy more.

Another retailer with a dominant position growing online sales while boasting a big yield is JB Hi-Fi Limited (ASX: JBH), although I still prefer Accent in the income space.