I must admit, buying shares in oil and gas producer Woodside Petroleum Limited (ASX: WPL) is starting to look enticing.

The recent fall in oil prices has been partly cushioned by the depreciation in the Aussie dollar and as a low-cost producer Woodside offers strong up-side potential if oil prices rise.

Before buying shares however, there are three things I think are important to check:

1. How much oil and gas does Woodside Petroleum have?

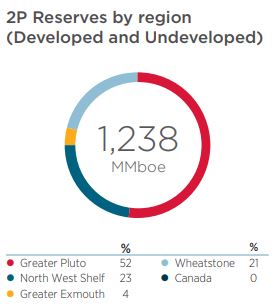

Woodside had 2P (proved plus probable) reserves of 1,238 million barrels of oil equivalent (mmboe) at the start of 2019.

If Woodside keeps pumping oil and gas at the same rate as it did in 2018 (91.4 mmboe), the company would have enough 2P reserves for the next 13.5 years. By the same measure, Santos Ltd (ASX: STO) would have enough for around 17 years.

Source: Woodside Petroleum 2018 Annual Report

Investing is about looking forward though and both Santos and Woodside are expecting to grow production, which will mean the companies will need to continue to unlock further reserves to keep producing.

Woodside has huge potential here and I'm keeping a close eye on the plans for Kitimat in Canada which makes up 48% of the company's potentially recoverable 2C Contingent energy reserves.

2. How much debt does Woodside Petroleum have?

Great question! Commodity prices are volatile and unpredictable. Debt amplifies the impact of price changes and can radically increase risks and returns.

Santos learned this the hard way when the price of oil plummeted in 2015 and it was left trying to service billions of dollars of debt with falling sales revenue.

At 31 December 2018 Woodside reported interest bearing liabilities of US$4.1 billion. This was down US$1 billion on the prior year and to me feels ideal. As a ratio of debt (short-term plus long-term) to equity that is 22% compared to Santos more levered up 67%, leaving plenty of room to invest in future development.

3. What is Woodside's cost of production?

The scale of Woodside's projects means it has become an incredibly low-cost producer of LNG. Each barrel of oil equivalent Woodside extracted in 2018 cost around US$5.1 to produce with a break-even cash cost of sale of just US$10.4 per barrel.

Foolish takeaway

Together these three points give me a sense that Woodside has upside potential if the price of oil rises and limited risk on the downside if it falls further, supported by a conservative balance sheet and the lower Aussie dollar.

They also set a useful starting point when thinking about investing in any commodity business before buying shares.