There is a fascinating fact buried deep in Woodside Petroleum Limited's (ASX:WPL) annual report that no one is talking about. And it is this:

Currently, 99% of Woodside Petroleum's annual production and 86% of 2P (Proved plus Probable) reserves come from Australia.

However, energy reserves come in 3 forms:

- 1P (Proved)

- 2P (Proved plus Probable)

- 2C (Contingent resources).

As 1P and 2P reserves get extracted, processed and sold, producers carefully evaluate the commercial viability of accessing the contingent 2C resources.

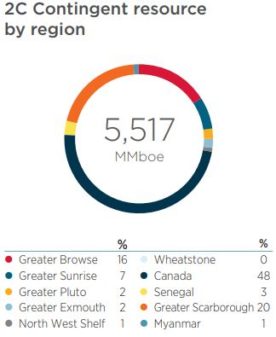

The fascinating fact about Woodside is that a full 48% of these contingent 2C resources are located in Canada. Although the company currently reports no Proved or Probable reserves in the region, almost half of its future growth potential is, in fact, in Canada.

Source: WPL 2018 Annual Report

Contingent resources have a lower probability of being economically recoverable than proven or probable reserves, and volumes can be speculative, but simply as a proportion of Woodside's portfolio, it's worth paying close attention to.

Woodside Petroleum's explosive growth potential

Woodside's Canadian resources center around two massive natural gas basins which are destined to feed the proposed Kitimat LNG development. Kitimat LNG is a 50/50 joint venture between Woodside and Chevron, which Woodside also works with on its North West Shelf project.

The prospects for Kitimat are vast and Woodside labeled it "one of the most advanced LNG opportunities in Western Canada" when it was acquired in 2015.

So far, the focus has been on designing a supremely cost-effective operation. The latest plan announced in April involves an all-electric design, which Chevron has apparently dubbed "the Tesla of LNG plants".

The Kitimat project falls into Woodside's long-term 'Horizon III' timeline and is ear-marked for development beyond 2027.

Foolish takeaway

Woodside is a proven partner in big energy projects and is taking a prudent 'slow and steady' approach to unlock the resources with maximum efficiency at a time of optimum global demand.

The time frame currently seems to be beyond the talking point for many, but Kitimat is exactly the type of growth project that long-term investors should have on their radars.