The Commonwealth Bank of Australia (ASX: CBA) share price will be on watch this morning following the release of the banking giant's full year results this morning.

How did CBA perform in FY 2019?

For the 12 months ended June 30, CBA reported an 8.1% decline in statutory net profit after tax to $8,571 million and a 4.7% drop in cash net profit after tax to $8,492 million.

The bank finished the period with a net interest margin of 210 basis points, which was in line with the first half of FY 2019.

Despite the decline in its cash profit, the bank maintained its full year dividend at $4.31 per share fully franked and reported a 60-basis point increase in its CET1 capital ratio to 10.7%. This puts the latter comfortably above APRA's unquestionably strong benchmark.

What were the drivers of its result?

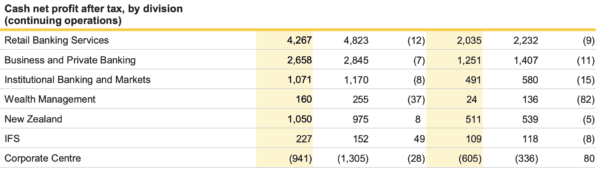

CBA's Retail Banking division was the biggest drag on its performance during FY 2019. It reported a 12% decline in cash net profit after tax to $4,267 million. This was driven by a 4% decrease in total operating income, a 3% increase in operating expenses, and a 6% increase in loan impairment expense.

Also weighing on its performance were its Business and Private Banking and Institutional Banking and Markets divisions. They experienced a 7% and 8% year on year decline in cash profits, respectively.

The former experienced a 1% increase in total banking income, an 8% increase in operating expenses, and a 47% increase in loan impairment expense. Whereas the latter division posted an 8% decrease in total banking income, a 2% decrease in operating expenses, and a 79% decrease in loan impairment expense.

A summary of all divisions can be found on the table below:

Buy now pay later investment.

Interestingly, CBA revealed that it has signed an agreement with Afterpay Touch Group Ltd (ASX: APT) rival Klarna. The bank has "committed an investment of US$100 million into Klarna Holding AB, as part of their US$460 million capital raise."

As a result of this investment, CBA will "become Klarna's exclusive partner in Australia and New Zealand and intend to further invest at the parent and local level to support this partnership."

Klarna is a leading global payments provider with over 60 million customers and 130,000 merchants. It generated US$627 million of revenue in 2018.

Outlook.

Chief Executive Officer, Matt Comyn, acknowledged the challenges the bank faces, but sounded optimistic on the future.

He said: "Our strategy is designed to deliver strong and sustainable outcomes for all our stakeholders. While the current context is challenging we have a strong franchise and our underlying business continues to perform well. We are focused on execution excellence in our business and extending our leadership in digital, and the Board and management team are committed to continued investment in our core business. We are also committed to maintaining a strong balance sheet to enable continued investment and to support long-term sustainable returns to shareholders."

And speaking about the economy, Comyn said: "we are in a lower growth environment but we are seeing improvement in the housing market including improved clearance rates, stabilisation of prices in Sydney and Melbourne, and slightly higher housing credit growth. Unemployment is likely to remain low and there is a pipeline of stimulus including tax cuts and infrastructure spending which has not yet flowed through. Population growth will remain supportive and commodity prices are helping to drive a strong trade performance. Ultimately household income growth will be key, as will the links to consumer and business sentiment in the coming years."

How does this compare to expectations?

According to a note out of Goldman Sachs, it was expecting the bank to deliver FY 2019 cash earnings from continued operations (pre-one offs) of $8,566 million. This would have been a decline of 3.9% on the prior corresponding period. As such, this result appears to have fallen a touch short of expectations.