The Nearmap Ltd (ASX: NEA) share price is down around 16% to $3.10 since the aerial mapping and software-as-a-service (SaaS) business told investors it's on course to boast $90.2 million in annualised contract value (ACV) as at June 30 2019.

ACV is the sum of all contracts in place over the next 12 months and as such is a forward looking revenue proxy figure popularised by SaaS investors and companies only too happy to adopt these valuation metrics given how often they have resulted in rocketing share prices.

Generally, SaaS businesses that are breaking even on a cash flow basis or even losing money will trade on around 15x forward sales to enterprise value as a standard ballpark multiple.

This is high and traditional value investors would claim valuing loss-making companies on multiples of sales is ridiculous, but the reality is these companies are popular due to their attractive economics, scalability powered by the internet, and long-term compound growth potential.

Of course what forward sales multiple to apply to a SaaS business varies greatly from business to business, as all will be growing at different rates, have different competitive advantages, and have widely ranging bottom lines from loss makers to highly profitable operations.

In its favour Nearmap is now operating on a cashflow breakeven basis is growing quickly (US ACV +76% yoy, & ANZ ACV +19% yoy) and the U.S. market in particular represents a potentially big growth opportunity. By ASX standards it also has a strong balance sheet with no debt and $75.9 million cash on hand.

Counting against it, among other things, is the fact that its product is not especially technologically advanced compared to other SaaS players, which means it does not have much of a moat and is vulnerable to competition or new technologies overtaking its product offering.

On the balance of probabilities then we can probably label Nearmap a 'middle of the road' SaaS business (of course this is subjective) and therefore apply a 15x forward revenue or ACV multiple to it.

This would give it a market value around $1.353 billion on a valuation of $3.02 per share based on 448.2 million shares on issue.

Today the market is valued a little above that at $3.10 and analysts such as Citi reportedly have 12-month price targets on the stock as high as $4.39.

By comparison another popular SaaS business such as Wisetech Global Ltd (ASX: WTC) has a valuation of $9.13 billion and trades on around 27x its forecast for FY 2019's revenue to come in between $326 million and $339 million. It's already very profitable and arguably has a wider moat or stronger competitive advantages than Nearmap. Its revenue is also likely to grow strongly in FY 2020.

While Pro Medicus Limited (ASX: PME) (a stock recently labelled 'a bubble' by a high profile fund manager) trades on 60x annualised FY 2019's revenues on a market value of $3 billion. Again though its revenue is likely to climb strongly in percentage terms in FY 2020 and it's already profitable with rising margins.

At the other end of the scale Catapult Group Ltd (ASX: CAT) trades on just 2.3x forecast FY 2019 revenue around $87 million. Counting against it is its loss-making status and management's habit of raising capital at increasingly lower share prices that you won't find in an MBA student's textbook.

Although these examples are rather eclectic and would need to be adjusted slightly for enterprise values we can see that Nearmap is currently trading on a middling SaaS valuation, whatever you think about investors willingness to buy into this new paradigm.

Finally, it's probably also worth noting that in its latest update Nearmap flagged a change to its accounting policies that will hit net profit from FY 2020 onwards.

Some software companies have traditionally capitalised some development or other expenses as this is a legitimate accounting trick that allows them to spread out the cost of these expenses over future years, despite the cash cost of them actually going out the door at the time. Therefore if these costs were expensed, rather than capitalised, they would reduce reported net profit after EBITDA.

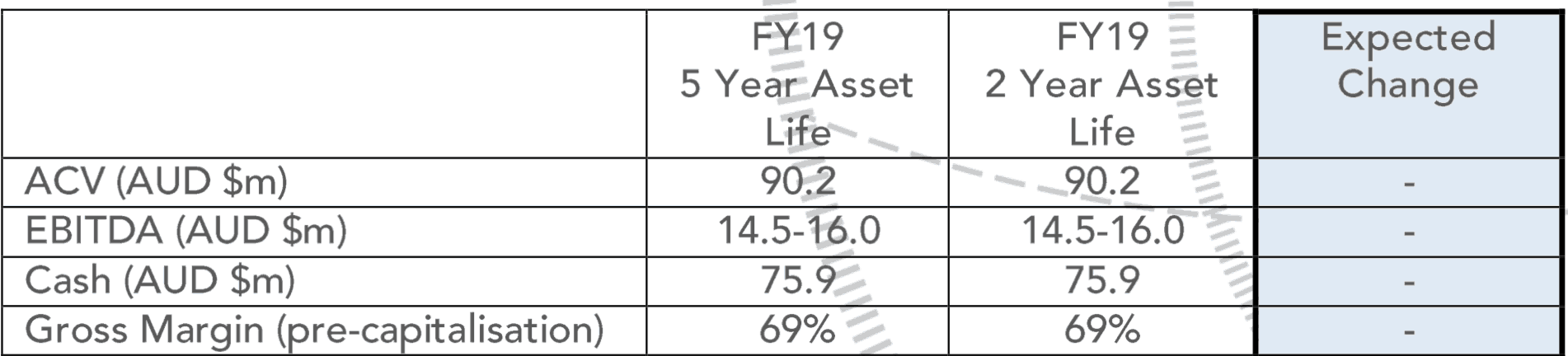

In the below chart we can see how Nearmap flagged that it will start to amortise capture cost expenses more aggressively due to older maps in effect becoming less relevant given its latest product developments such as 3D and AI. In other words as newer maps or products become more important it's been decided the cost of developing them should be worn more quickly.

The below chart is how Nearmap cunningly asked investors to think about the change….

Source: Nearmap investor presentation July 12, 2019.

While it's correct that the accounting change makes zero difference to the amount of cash coming in or going out the door, it's worth noting that its accounting net profit below the EBITDA line will take a hit due to the rising amortisation expense.

At the end of the day though this company and its stock will be valued on free cash flow generation and the most recent operating metrics all suggest it still has potential to generate strong free cash flow growth into the future.

Overall then I remain optimistic on the group's future and would have the shares at around fair value for now. Of course investors must also remember that the stock comes with considerable risks as well and any holding should only be a small part of a balanced investment portfolio.