Just about every sector has gained ground today as the S&P/ASX 200 (Index:^AXJO) (ASX:XJO) index jumped higher on broad-based buying.

But don't be fooled into thinking that the entire market is a buy even though the share market on the whole will benefit from falling interest rates. If anything, Citigroup is warning investors to stay away from one part of the market – retail property stocks.

The warning isn't hurting sentiment towards the sector though with the Charter Hall Retail REIT (ASX: CQR) share price jumping 2.6% to $4.69, Shopping Cntrs Austrls Prprty Gp Re Ltd (ASX: SCP) share price gaining 1.7% to $2.65 and Vicinity Centres (ASX: VCX) adding 0.8% to $2.63.

Retail property values set to fall

But the optimism may not last if Citigroup's prediction comes to pass. The broker believes that property values in this sector is about to fall and Vicinity's latest update highlights the downside risk.

The owner of Australia's largest shopping centre, Chadstone, lowered the value of its property portfolio by 1.3% to $202 million. The capitalisation rate is largely stable and this suggests that the downgrade was due to cashflow pressure.

The capitalisation rate is one of the most common measures used to measure returns on real estate. It's calculated by taking the net operating profit and dividing it by the purchase price of the property (assuming cash is used).

The positive revaluation of Vicinity's Chadstone and DFO centres was more than offset by reductions in the value of its other properties, including Western Australia and regional properties.

Citigroup noted that other retail property stocks have more in common with the underperforming parts of Vicinity's portfolio.

Retail stocks to sell

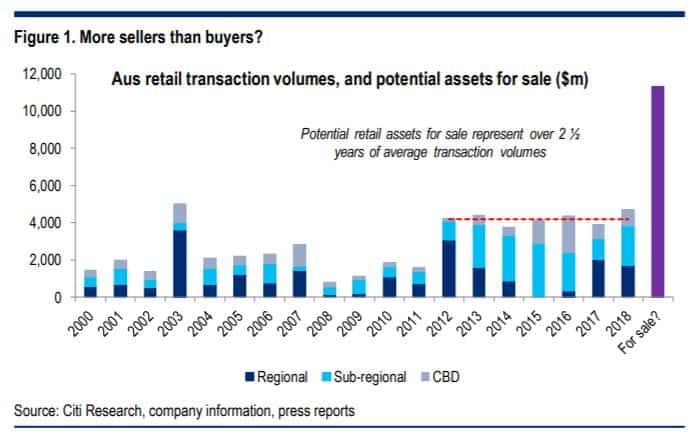

"We maintain our negative view on the retail landlords given a large overhang of assets on the market. We estimate potential for disposals of c. $11bn of Australian retail assets, or close to three years of typical transaction volume," said Citigroup.

"The selling appears to be very broad-based, with key buyer segments including unlisted funds and offshore investors having recently turned sellers. We therefore expect shopping centre values will continue to fall, as pricing adjusts to help clear the market."

Citigroup has a "neutral" rating on Vicinity but a sell on just about the rest of the sector. The stocks that the broker is urging investors to dump include Scentre Group (ASX: SCG), GPT Group (ASX: GPT), BWP Trust (ASX: BWP), Shopping Centres Australia and Charter Hall Retail.

On the flipside, if you are looking for stocks that are well placed to outperform in 2019, you will want to read this free report from the experts at the Motley Fool.

You can access this report by following the free link below.