Investors in QANTM Intellectual Property Ltd (ASX: QIP) could see more share price volatility this morning following an after-market update on its planned merger with Xenith IP Group Ltd (ASX: XIP).

What did Xenith say in the announcement?

QANTM noted the ACCC approving the proposal from IPH Limited (ASX: IPH) to acquire Xenith but said that the QANTM-Xenith merger remains compelling value. The company urged Xenith shareholders to look at the fundamentals of the QANTM proposal including the following:

- The real underlying value presented by the QANTM – Xenith merger of equals remains unchanged since the proposed merger was announced.

- Short-term share price movements are not the best measure of the value of the QANTM – Xenith merger.

- The rationale for the QANTM – Xenith merger is compelling due to the creation of a market leading group of independent IP services businesses in Australia, New Zealand and Asia.

What did the ACCC say earlier in the day?

The Xenith share price gained more than 5% yesterday on news of the ACCC approval for IPH's proposal to combine IPH with Xenith.

The ACCC's approval of the IPH proposal reduces the regulatory and execution risk of the IPH proposal, with IPH planning to use its 19.9% stake in Xenith to vote against the Xenith – QANTM merger.

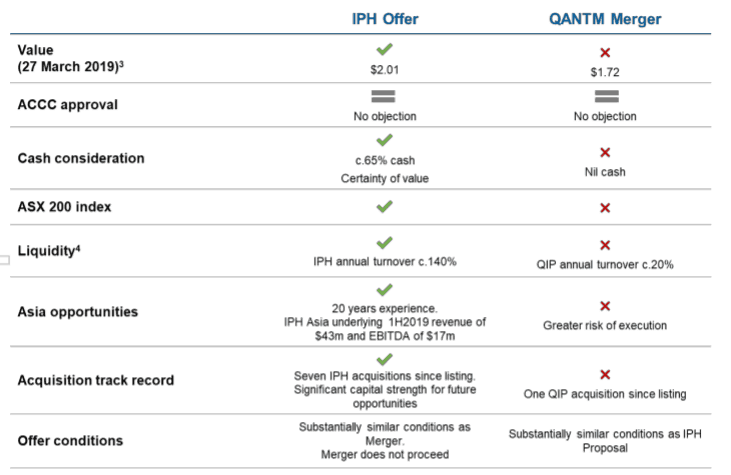

Under the IPH offer, each Xenith shareholder would receive $1.28 in cash and 0.1056 IPH shares for every one Xenith shares they own. IPH also said that since the announcement of the IPH offer, the value of the Xenith – QANTM merger has "materially decreased" and the value of the IPH offer has increased to a pro-forma value of $2.01 per share.

IPH provided the below summary of its take on the value of the two offers:

Should you buy any of these shares?

This whole process has played out quite messily for all parties involved, with IPH's strategic stake in Xenith complicating the situation even further.

I'm personally not in the business of punting on mergers and acquisitions, and I'd prefer to let the dust settle and invest based on the fundamental value that's available as a shareholder in the years to come.

For investors who are willing to roll the dice and venture into new industries, this top-rated growth stock is in the buy zone and could be set to surge higher in 2019.