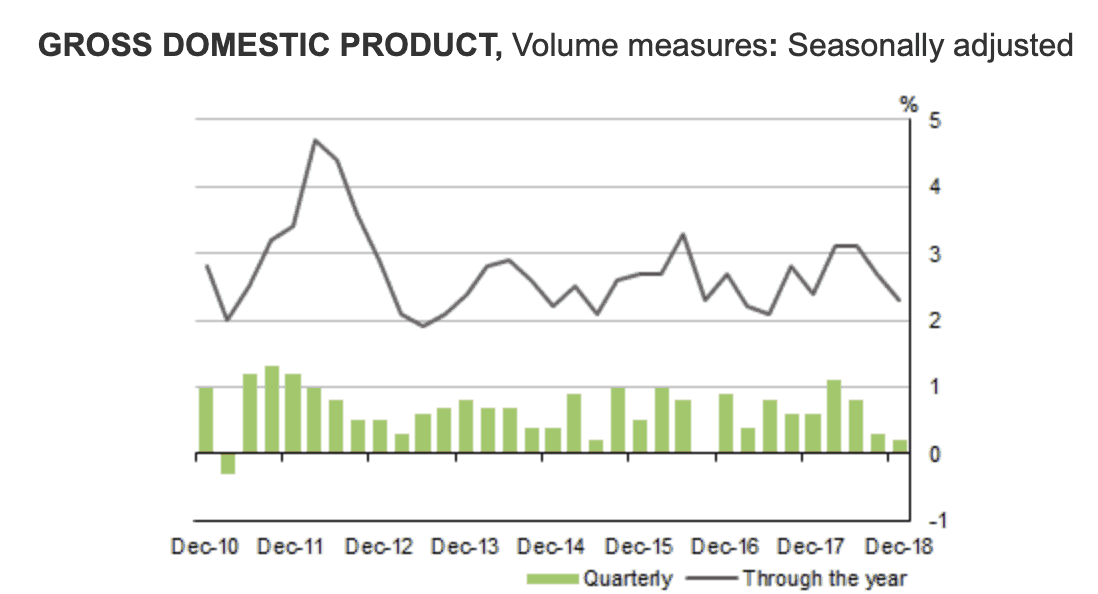

The Australian Bureau of Statistics (ABS) this morning reported that Australian gross domestic product growth fell to 0.2% over the quarter ending December 31 2018. On an annual basis the economy grew 2.3%.

The chart from the ABS below shows how quarter-on-quarter growth (green bars) has declined through 2018 to 0.2% for the December quarter, with the declines in line with house prices, consumer confidence, and China's growth that is now at its slowest since 1990.

Source: ABS, March 6, 2019

If the economy were to deliver two consecutive quarters of negative GDP growth (<0%) then it would officially be in an economic recession that it has managed to avoid for the last 27 years.

This explains why the RBA has held lending rates at the 'emergency' low levels of 1.5% for the past 31 months in a bid to avoid an Australian recession that would smash economic and consumer confidence further.

It was the growth of China's economy and its demand for the "Lucky Country's" natural resources that saw Australia avoid a recession during the GFC, with China's once-in-a-generation construction super-cycle unlikely to ride to the rescue again.

This means the RBA may be forced to cut lending rates even lower in 2019 in an attempt to stimulate demand and economic growth.

The benchmark S&P/ ASX200 Index (ASX: XJO) has responded well to the weak GDP data as investors bet stimulus from the RBA in the form of cheaper money will boost spending and intensify the search for yield even if it involves taking on more risk via shares.

For example shares in popular dividend-paying blue chips such as National Australia Bank Ltd (ASX: NAB) and Commonwealth Bank of Australia (ASX: CBA) are rising this lunchtime as another rate cut is likely to prop up the housing market and encourage the hunt for yield via dividends.

However, for share market investors a better theme to focus on is the potential for the Australian dollar to fall further in 2019 on the back of rate cuts.

A falling Aussie means some of the local markets best companies such as CSL Limited (ASX: CLS) or Cochlear Ltd (ASX: COH) are likely to earn even higher profits for investors. I'd prefer them to the banks.