This morning the Australian Foundation Investment Company (AFIC) reported its financial results for the half-year ending December 31 2018. Below is a summary of the results with comparisons to the prior corresponding half.

- Half year profit of $239.8 million, up 75.4%

- 'Investment income' totalled $250.3m, up 69% and supported by participation in Rio Tinto and BHP share buybacks

- Profit per share came in at 20.1. cents

- Interim dividend 10 cents per share, flat on last year

- Special dividend of 8 cents per share declared thanks to cash flows from Rio and BHP buy-back participation

- NTA per share before any provision for deferred tax on the unrealised gains of $5.69, down from $6.19

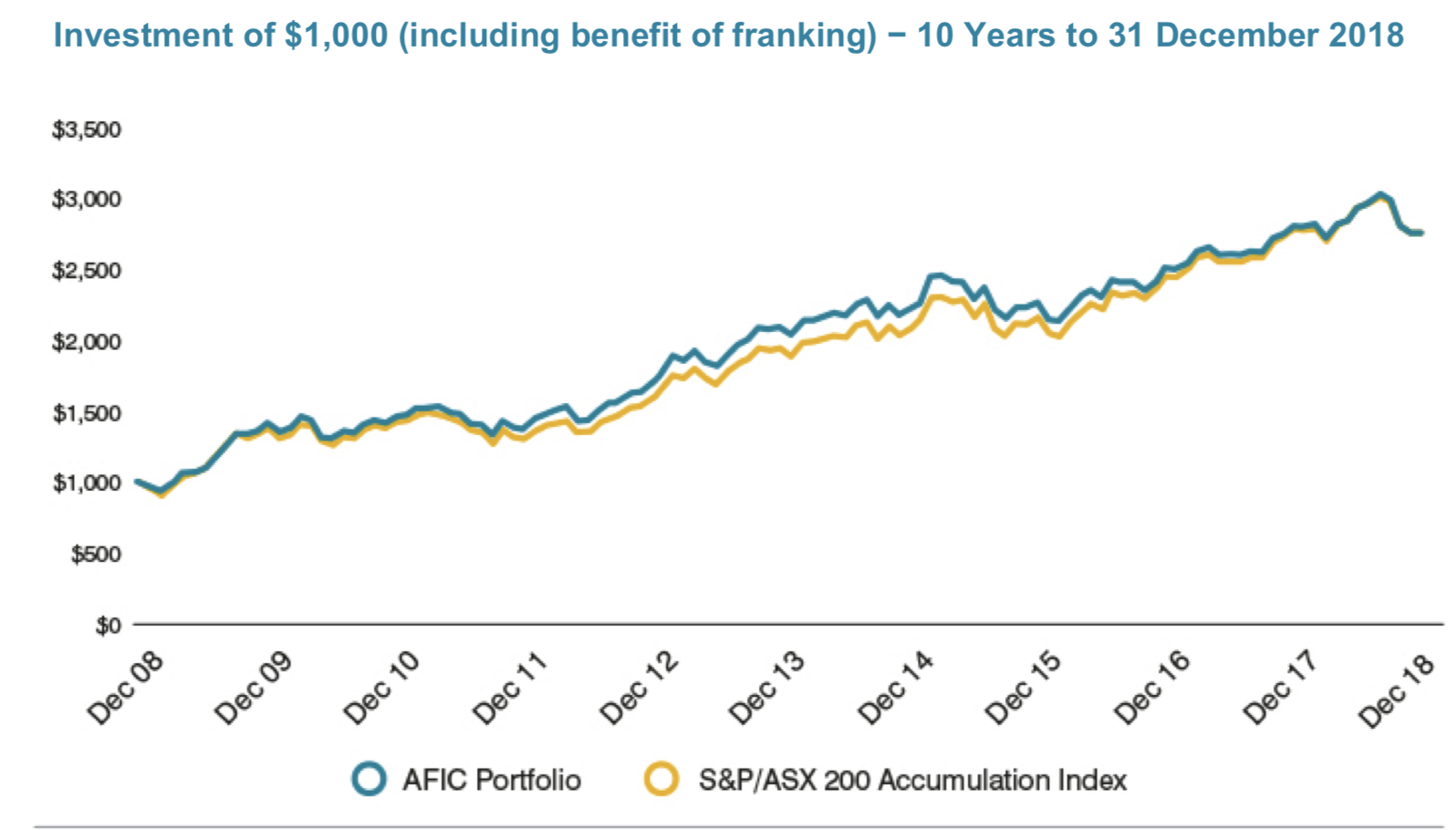

- Six-month portfolio return including franking was -6.4%, versus -6.2% for S&P/ ASX200 Accumulation Index

- One-year portfolio return including franking was -2.3%, versus -1.4% for S&P/ ASX200 Accumulation Index

By Australian standards the AFIC fund is huge at $6.8 billion which means it has little choice but to own a heavy selection of companies within the S&P/ASX50 index of 50 leading companies or the wider S&P/ ASX200 Index.

This in turn means it is likely to hug the index as its top holdings are likely to broadly align with the largest holdings in the index. The chart below speaks louder than words:

Source: AFIC Investor Presentation.

The fund's primary appeal is its ultra-low cost with a 0.14% management fee and no performance fees.

It will also appeal to tax-effective dividend seekers in the retirement stage, although the Labor party's proposal to abolish certain franking credit cash refunds could hit many of AFIC's rich retiree investors especially.

Four of the fund's top eight holdings are the fully franked dividend-paying banks in Commonwealth Bank of Australia (ASX: CBA), National Australia Bank Ltd (ASX: NAB), Australia & New Zealand Banking Group (ASX: ANZ) and Westpac Bank (ASX: WBC), with Australian banks making up 21% of the portfolio.

The AFIC company traded on the ASX then is likely to offer investors returns and dividends similar to the broader S&P/ ASX200 over the years ahead. As such it looks more suitable for retirees after income and stability, than anyone interested in growth.