Software-as-a-service supplier Livetiles Ltd (ASX: LVT) this morning announced it has hit $22.9 million in annualised recurring revenue (ARR) as at December 31 2018, which represents growth of 232% from the $6.9 million as at this time last year and growth of 23% from $18.6 million as at the quarter ending September 30 2018.

The numbers are inflated slightly by the acquisition of the Hypefish business that completed in June 2018 with more than a US$1 million of ARR delivered by Hypefish as at December 31 2018. Livetiles will issue 6.77 million shares to the Hypefish vendors as the ARR means it has hit its first earn-out target in the acquisition agreement.

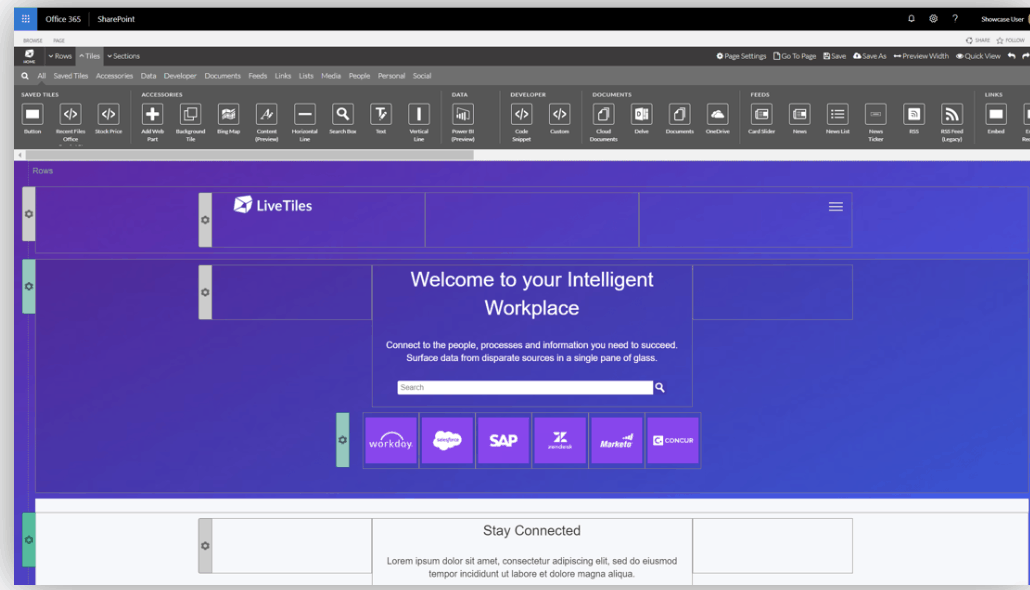

Livetiles software allows enterprise or commercial government customers to build an intranet system that lets employees easily connect to multiple other third-party platforms and potentially improves efficiencies and the functionality of the digital workplace.

Source: Livetiles website

It also recently signed a deal with Microsoft Inc. to help improve the Artificial Intelligence (AI) functionality on its platform and it has signed an agreement with sales partner in N3 Inc. to effectively outsource or grow some of its key sales efforts.

It reports that the N3 team has already built a sales pipeline worth $50 million to Livetiles.

"Importantly, we have also continued to build a very large pipeline of sales opportunities, driven by the N3 sales and marketing channel and our unique global partnership with Microsoft. We remain focused on converting this large and growing pipeline into new customers in FY19 and beyond," commented CEO Karl Redenbach.

Should you jump in?

The stock is up 11% to 38.5 cents in response to today's news which gives it a market cap of $211 million on 9.2x ARR, but the concern is that much of the growth is coming from ballooning costs.

In fact the operating cash loss for the quarter ending September 30 2018 hit $11 million, with a forecast for the cash loss for the quarter ending December 31 2018 to come in at $13.1 million. The large staff costs being attributed in part to the deal with N3 Inc. to boost its sales efforts and reach.

Livetiles had cash on hand of $32.1 million as at September 30 2018 and is likely to divide investors, given growth is being delivered but at a significant cost. I'd watch it from the side lines for now.

Yesterday we saw another software company in Livehire Ltd (ASX: LVH) report trailing quarterly revenues of just $924,000 despite it having a market cap of more than $140 million, although its cash outflows are far more manageable.