"Good morning, Scott", Chris Smith said as he introduced me on Sydney's 2GB radio station today. I've been doing a morning business update over the last week (and into next week).

"Well, not such a good morning for investors, based on what's been happening overnight on US markets…" I replied.

"The NASDAQ is off another 1.7% overnight", I said.

But ever the (capital-F) Fool, I wanted to both address what people were talking about, but also give it some context.

"It's in what the financial types call an 'official' bear market, being 20% lower than its recent highs in August."

…

"But the NASDAQ 100 is also up over 5% in 2018, thus far."

"Perspective matters."

Yes, perspective matters.

So does temperament.

You see, there are people who simply can't keep those two ideas in their heads at the same time. I don't blame them — we're all different. But it's important to know.

Is the NASDAQ — the US stock market index comprising mostly tech stocks — down 20%? Or is it up 5%?

Yes.

Both.

I want to share my most successful ASX recommendation with you. And full disclosure, up front, I own shares.

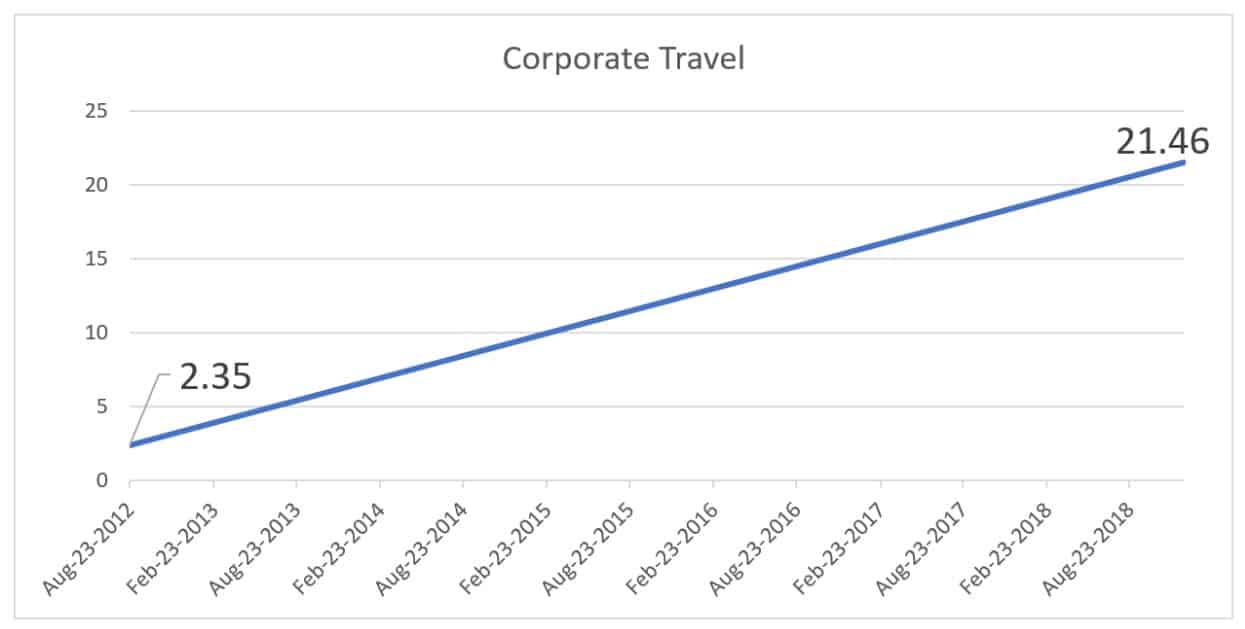

I recommended Corporate Travel Management (ASX: CTD) to members of Motley Fool Share Advisor back in August 2012 (and twice again, since). Here's the return they've received if they followed that advice:

You'd take that, right?

Of course, I didn't know, in advance, how well the shares would do. That's a 9-bagger, by the way.

And it doesn't include dividends, which makes it a hair's-breadth away from a 10-bagger.

At this point, I imagine a few of you are saying 'Hang on… it wasn't just a straight line throughout that time! And you know what… you're dead right.

Here's that same chart, with daily share price movements overlaid:

A different story? Or the same one?

Well, again: both. The data, courtesy of S&P Capital IQ, tells me that since our recommendation, there were about 1600 days when CTM shares traded on the ASX.

Of those:

Shares fell by 1% or more on 398 individual days. That's 25% of the time!

Shares fell by 2% or more 179 times. One day in 8.

They fell 5% or more in a single day on 18 separate occasions!

And overall?

There were only 69 days when the price didn't move, at all.

There were 737 days when the price fell.

And 797 days when the price rose.

That means it only rose 60 times more than it fell, despite being up 800%!

Let that sink in for a minute.

Put another way, the share price was unchanged more often (69 times) than the difference between number of days rose, and those that fell (60).

Was it worth those 737 days of falls to turn a hypothetical $20,000 into $180,000?

I don't know about you, but I reckon I'd try pretty bloody hard to get used to volatility, if that was the payoff.

It doesn't mean you have to like it. The headlines will give you the bad news, because that's what we like to read. But they won't tell you the full, long-term, story.

Invest accordingly.

Oh, and Happy Gravy Day.

Fool on!

Scott Phillips

Chief Investment Officer

Motley Fool Australia