The share prices of some of the ASX's most popular consumer goods companies that sell products into China via online channels are rocketing today on the back of some reported changes to the official Chinese "cross border e-commerce channel (CBEC)".

According to news reports in The Australian newspaper China has announced a "new regulation" will come into effect from January that means goods sold via CBEC "would not require compliance with China's domestic regulations".

This is considered good news as many in the market were concerned that companies like Bellamy's Australia Ltd (ASX: BAL) may end up in a regulatory no man's land by 2019 unless they received updated licences or new approval for routes such as CBEC to sell their goods in China.

Today, Bellamy's shares have surged 5.3% to $7.59, shares in the A2 Milk Company Ltd (ASX: A2M) are up 6.6% to $9.97, shares in Treasury Wine Estates Ltd (ASX: TWE) are up 5.7% to $14.29, and Blackmores Limited (ASX: BKL) shares are up 6.6% to $134.27.

In an additional bonus for investors in the vitamins manufacturer The Australian newspaper is also reporting that analysts at Macquarie Group Ltd (ASX: MQG) have put an "outperform" rating and "$150 share price target" on Blackmores shares.

The positive rating is unsurprisingly based on Blackmores' sales potential in China, with the group already delivering very strong growth in this giant market.

The Macquarie analysts also noted that they expect the Chinese government to be supportive of "growth in cross border e-commerce trade" in another positive signal for investors in stocks linked to demand from the rising Chinese middle class.

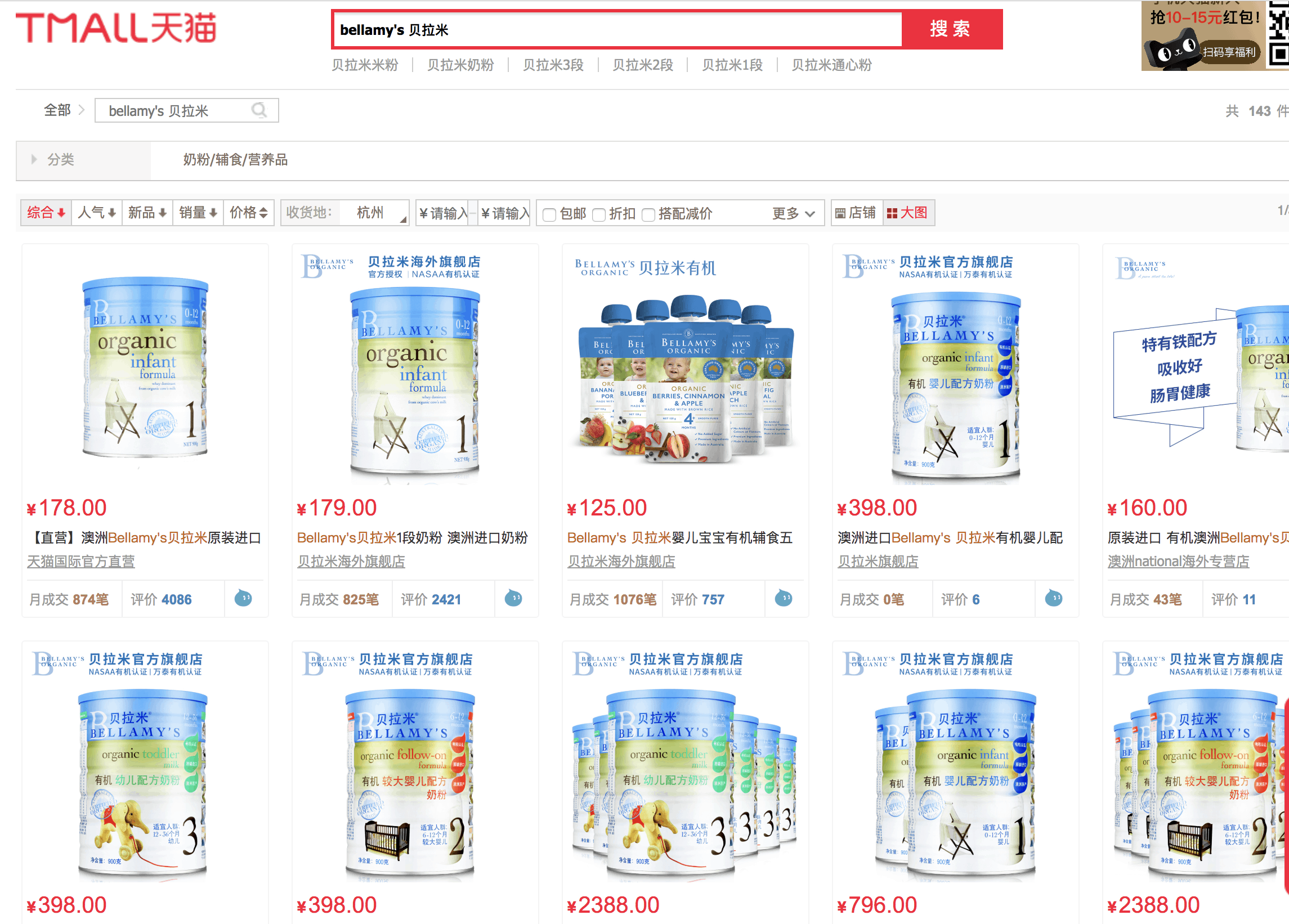

Cross border e-commerce trade is important to all of the ASX-listed foodstuffs businesses as local Chinese shoppers in Australia (know as daigou) commonly buy goods in wholesale quantities to sell on in China for a mark-up via popular e-commerce sites such as Alibaba's Tmall. The companies also sell their products directly on these popular consumer-shopping websites.

Souce: Tmall.com November 22, 2018.

Investors then should keep a close eye on the changing regulatory environment as it remains very important to all of these businesses.