The Australian share market certainly is having a day to forget on Tuesday. In afternoon trade the benchmark ASX 200 is down a sizeable 1.7% with almost all sectors dropping lower.

The same cannot be said for the Orocobre Limited (ASX: ORE) share price, though. At the time of writing the lithium miner's shares have defied the market selloff and pushed 3.5% higher to $4.70.

This is despite industry peers Galaxy Resources Limited (ASX: GXY), Kidman Resources Ltd (ASX: KDR), and Pilbara Minerals Ltd (ASX: PLS) all falling heavily today.

Why are Orocobre's shares storming higher?

This morning Orocobre released an investor presentation and the market appears to have liked what it saw.

As well as providing an update on its operations and the improvements it has experienced with pricing and costs, management provided an update on the lithium market.

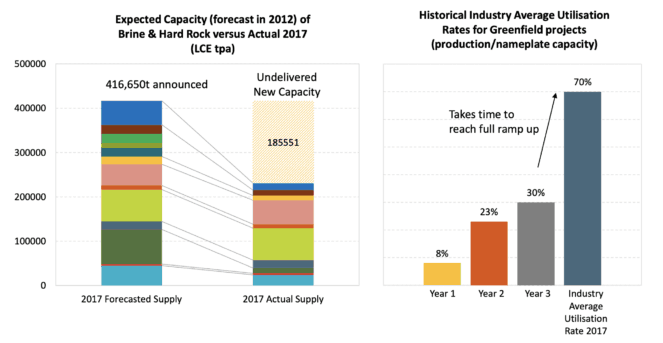

One thing of note that management pointed out in the presentation was how inaccurate long-term supply forecasts have been in the past. As you can see below, 2017's supply fell well short of predictions.

Management has put this down to increased royalties and taxes in Chile, the under-delivery of conversion plan capacity expansions and brownfield brine expansions, and new hard rock supply at lower than expected grades.

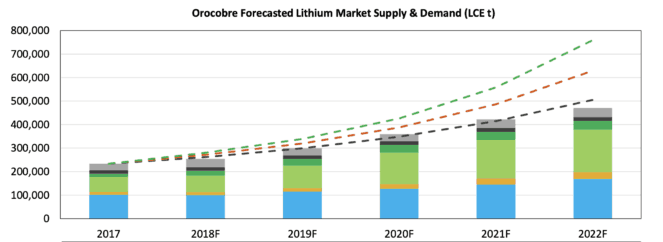

The good news for Orocobre shareholders is that management appears confident that the lithium market will remain tight in the future and support high prices of the battery making ingredient.

On the above chart, the green dotted line represents its optimistic demand forecast, whereas the red line represents the base demand forecast, and the black line represents the pessimistic demand forecast.

The base case is for demand to grow by 22% per annum between 2017 and 2022. This is expected to be driven by increasing electric vehicle (EV) adoption and implies EV penetration of 4.4% by 2020.

The pessimistic forecast implies 17% growth in demand per annum during the period and EV penetration of 3.5%. Finally, the optimistic forecast is for demand growth of 26% per annum and EV penetration of 5.4%.

And in respect to supply, Orocobre expects persisting bottlenecks, slower ramp-ups, and higher costs to limit supply growth and lead to continued tight market conditions.

Whether or not this forecast proves accurate, only time will tell. But if it is correct and demand grows at the base level, I expect Orocobre and its peers to benefit from favourable lithium prices for many years to come.

This could make them worth considering, but only if you have a high tolerance for risk and can stomach the high levels of volatility that their shares exhibit.