The Nufarm Limited (ASX: NUF) share price will be one to watch next week when it returns from a trading halt.

This morning the company released a disappointing set of results for FY 2018 and announced a $303 million pro rata renounceable entitlement offer.

Here's how Nufarm performed in FY 2018 compared to a year earlier:

- Revenue increased 6% to $3,308 million.

- Underlying EBITDA down 1% to $386 million.

- Underlying net profit after tax fell 28% to $98 million.

- Reported net loss after tax of $16 million.

- Full year dividend down 15% to 11 cents per share.

- $303 million pro rata renounceable entitlement offer announced.

Although a weak full year result was expected due to the negative impact of the drought in regional Australia, this result may have been even worse than feared.

According to a note out of Goldman Sachs this week, it was expecting the crop protection and specialist seeds company to post a net profit after tax of $111.4 million, down 18.1% on the prior period. Whereas its underlying result was $98 million, down 28% on FY 2017's result.

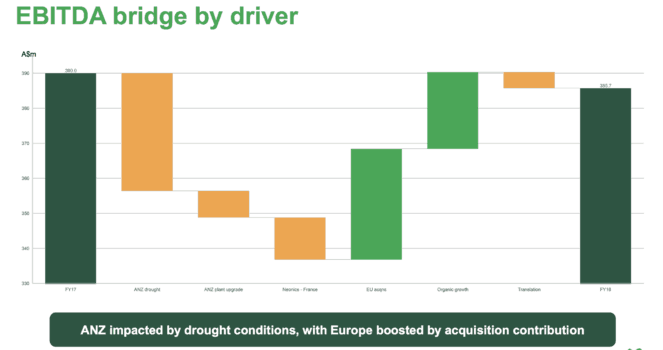

As you can see below on the EBITDA bridge, the drought (first orange column) had a major impact on its result and offset the benefits of its European acquisition and organic growth.

Had it not been for the ANZ segment, FY 2018 would arguably have been a reasonably positive year for Nufarm.

Its North American segment saw sales and EBIT rise 10%, the Latin America segment achieved sales growth of 8% and EBIT growth of 2%, the European segment grew sales by 19% and EBIT by 1%, and the Asia segment saw sales rise 3% but EBIT fall 9%.

Outlook.

Assuming average seasonal conditions for the major selling periods in its key markets and no material impacts from government policy changes or third party supply interruptions, management expects EBITDA to be in the $500 million to $530 million range for the FY 2019 financial year.

This will be an increase of between 29.5% and 37.3% on FY 2018's result and is expected to be driven by a combination of revenue growth, the partial recovery in the Australian business, and the full year benefit of its European acquisitions.

Entitlement offer.

As well as announcing its results, the company announced a $303 million pro rata renounceable entitlement offer.

All shares offered under the offer will be issued at a price of $5.85 per share, which represents an 11.9% discount to dividend-adjusted last close price of $6.64.

The proceeds will be used to strengthen its balance sheet and help fund the continued growth of its business.

Should you invest?

Based on today's underlying result and the addition of 52 million new shares to the registry, I estimate that Nufarm's shares are changing hands at 24x underlying earnings.

I don't think that this is particularly good value for its shares and would suggest investors hold out for a better entry point.

In the meantime, I see more value in materials sector peers BHP Billiton Limited (ASX: BHP) and Rio Tinto Limited (ASX: RIO).