Bank shares are running higher today but if you are tempted to bargain hunt in this beaten down sector, you might want to wait till after next week before dipping your toes back into the murky waters.

This is because the Hayne Royal Commission will hand down its interim report on the sector by end of September and it could be a doozy.

While the risk of tighter regulations and a damning assessment of our big banks and AMP Limited (ASX: AMP) are largely reflected in current share prices given the sharp derating of the sector, no one knows for sure what Commissioner Kenneth Hayne will say in the interim report.

The share price of AMP is down 38% since the start of 2018, while Commonwealth Bank of Australia (ASX: CBA) and Westpac Banking Corp (ASX: WBC) have lost 10% of their value.

Australia and New Zealand Banking Group (ASX: ANZ) is faring the best with a flat return and National Australia Bank Ltd. (ASX: NAB) is 7% in the red. In contrast, the S&P/ASX 200 (Index:^AXJO) (ASX: XJO) index is up 2%.

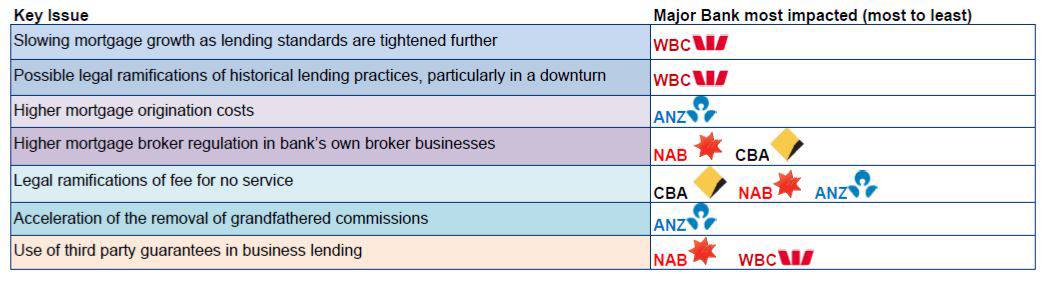

The share price performance gives you a good idea of which companies have the most to lose and Citigroup has attempted to quantify the share price risk for the big four banks. The broker sees a 20% downside to the current share price of Commonwealth Bank under its bear case scenario while Westpac is second with a circa 11% downside.

A Royal Belting: Banks most at risk from the Hayne Royal Commission

Source: Citigroup

The interim report will focus on two areas. The first is responsible lending, where current systems and processes have allowed the banks to lend too much to borrowers. Hayne will probably make preliminary recommendations on tightening lending standards and banning the use of the Household Expenditure Measure (HEM).

The second area is governance failures in providing investment advice. You can bet it will be a damning report given the widespread failures in the industry. The big banks may have sold (or are about to sell) their wealth businesses, but this won't let them off the hook.

"The drama of the RC [Royal Commission] in 2018 has seen earnings estimates and share prices incorporate the financial implications of these anticipated findings. The risk, however, is the impact of the implementation is significantly larger than we and the market expect," said Citi.

"Therefore, we suggest a preference for the commercially orientated banks of ANZ and NAB over the retail-orientated WBC and CBA to mitigate this outcome."

Citigroup has a "buy" recommendation on ANZ Bank and National Australia Bank and a "neutral" rating on Westpac and Commbank.

Other areas, such as insurance and superannuation will probably be covered in the final report, which is due to be released on February 1, 2019.

If the findings in this report aren't any worse than what the market is expecting, bank and AMP shares will likely surge higher. But you are rolling the dice if you buy these stocks now.