This afternoon both Australia and New Zealand Banking Group (ASX: ANZ) and Commonwealth Bank of Australia (ASX: CBA) followed in the footsteps of banking rivals Westpac Banking Corp (ASX: WBC) and Suncorp Group Ltd (ASX: SUN) by announcing plans to increase variable home loan interest rates in Australia.

According to the ANZ Bank release, the bank has made the move following the sustained rise in wholesale funding costs as well as consideration of business performance and market conditions.

But importantly, there will be no change to effective rates for home loan customers in drought-declared regional Australia.

What are the rate changes?

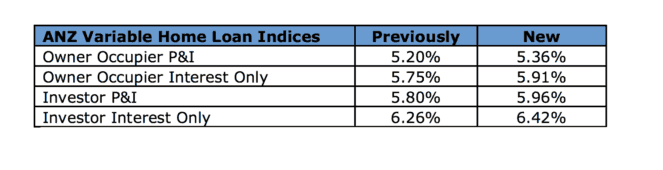

Effective on September 27, ANZ Bank will increase variable interest rates for Australian home and residential investment loans by 0.16% per annum.

The table below demonstrates what this rise means for homeowners and investors:

ANZ Bank's group executive Fred Ohlsson has stated that: "This was a difficult decision given we know the impact rising interest rates have on family budgets. The reality is it is more expensive for us to fund our home loans on wholesale markets and we also needed to balance the needs of all stakeholders."

Before adding: "There is no change to the effective rates of our home loan customers in drought declared regional Australia benefiting more than 70,000 of our customers. We wanted to play our part in keeping cash in regional towns impacted by the drought and we hope this will also assist both families and small businesses in these areas."

In respect to CommBank's rate rise, which came just minutes after ANZ Bank's announcement, Australia's largest bank will increase variable home loan rates for owner occupied and property investment loans by 0.15% per annum effective October 4.

Should you invest in bank shares?

I think this was a sensible move by ANZ Bank and CommBank, and expect National Australia Bank Ltd (ASX: NAB) to follow suit in the near future.

This should create a level playing field for the big banks and put them in a stronger financial position.

In light of this and the low multiples their shares trade on, I think the big four banks are attractive investment options right now. Especially given the generous yields their shares offer.