This morning Australian equity focused fund manager, financial advice, and trustee services business Perpetual Limited (ASX: PPT) reported its financial results for the year ending June 30, 2018. Below is a summary of the results with comparisons to the prior year.

- Net profit of $140.2m, up 2% on prior year

- Operating revenue of $533.7m, up 4%

- Final fully franked dividend of $1.40 per share, taking full year dividends to $2.75, up 2%

- Core funds management business profit before tax of $112.5m, down 3%

- Funds management business saw net outflows of $2.5 billon over year

- Perpetual Private (family / HNW individuals, or small business facing financial advice business) grew profit before tax 14% to $46.1m

- Perpetual Corporate Trust (trustee services business) grew profit before tax 16% to $42.6m

This result is characterised by the success of the two businesses that many considered as expendable to the core funds management business. Now however, Perpetual Private and Corporate Trust make up around 40% of total group profit before tax.

The financial advice business benefiting from the success of its Fordham Group as it attracts more clients that require accounting, tax planning, and other general financial advice.

The business has no particular competitive advantage, but its success is impressive given the annus horribilis for the financial advice industry in Australia.

The trustee business that acts for debt issues such as mortgage backed securities, alongside acting as a trustee for a bevy of boutique fund managers is also tracking well.

Again, it contains little in the way of a competitive advantage versus Equity Trustees (ASX: EQT) for example, but it appears there's plenty of work to share around.

Unfortunately for Perpetual shareholders the group's funds management business is still hampered by the same problem I have highlighted multiple times over the past 4 years.

It suffered $2.5 billion of (primarily institutional) net outflows over FY 18 on only just over $30 billion of FUM. Worse is that its past management teams seemingly had no solution to the task of growing FUM.

Of course poor investment performance is no help to the institutional business development effort, but the embarrassing track record of FUM growth since the GFC shows the truth about the all-round quality of the investment management business. It's poor.

Institutional FUM flows are generally about investment performance and the quality of the people and pitch, with $2.5 billion of outflows in FY18 speaking for themselves.

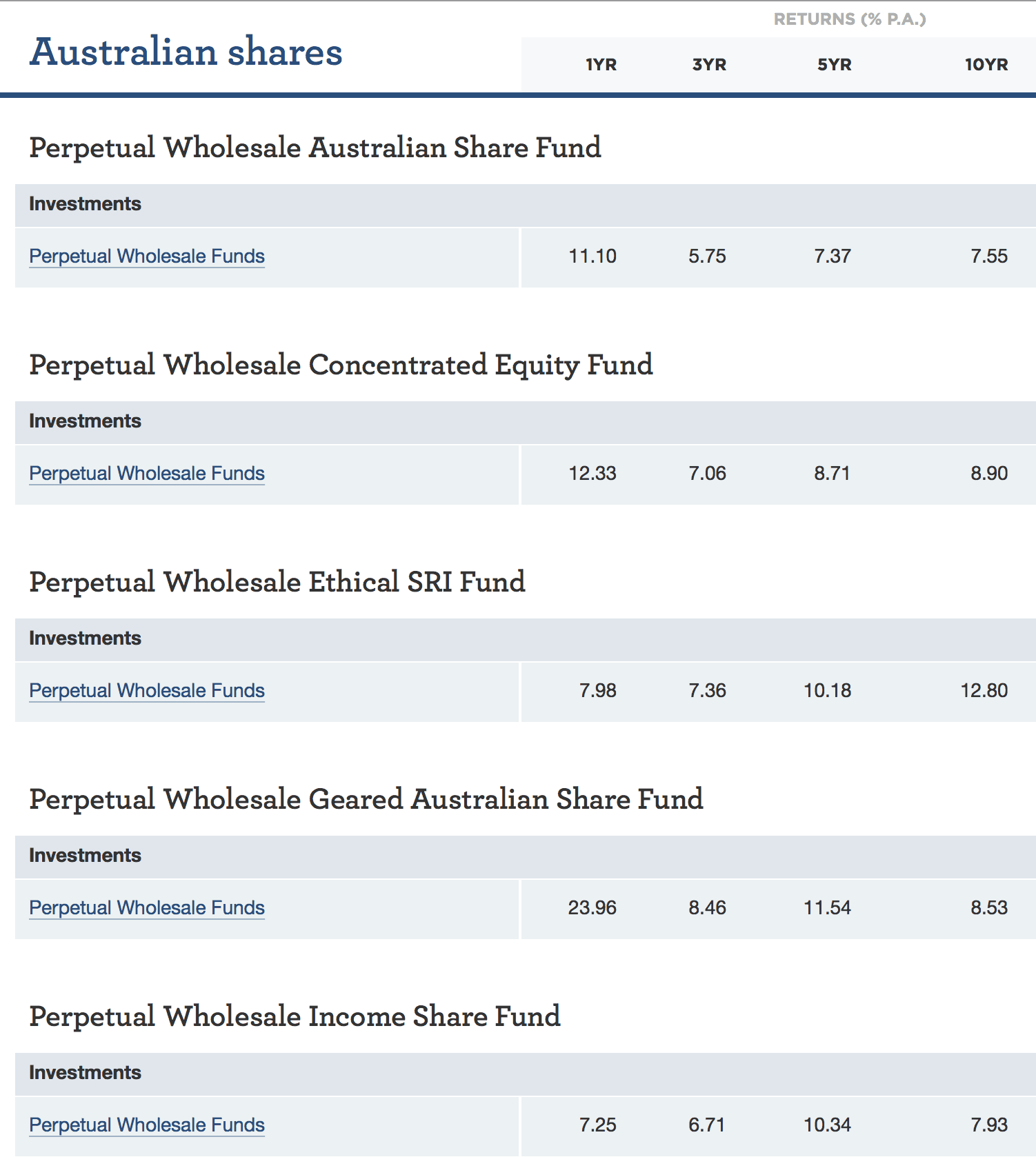

If you look below you can see that many of Perpetual's flaghip funds' returns over the past 5 to 10 years are in the mid-to-high single digits, which means the only surprise is that more FUM has not walked out the door.

Source: Perpetual website at at August 30, 2018.

The group blamed the returns on the "market cycle continuing to favour growth style investing over value investing", with the returns actually reflecting a lack of real expertise in the funds management space.

Overall, Perpetual remains a long way off investment grade as a business, and this is unlikely to change without root and branch reform that is almost certain to never happen.

I've flagged multiple times before that investors looking to do well in the asset management space should look to the likes of Magellan Financial Group Ltd (ASX: MFG).

Perpetual likes to boast of its 125-year history, but it's taken it that long to get to $30 billion in FUM.

While Magellan has built a $70 billion funds management business since 2008 – a harsh lesson in what's possible if you know what you're doing.

I'd forget Perpetual!