The Bravura Solutions Ltd (ASX: BVS) share price has been a huge mover on Tuesday and hit an all-time high of $4.25 in early trade following the release of its full year results. It shares have since given back some of these early gains but still sit almost 10% higher at $3.95.

In FY 2018 Bravura Solutions saw revenue increase 15% to $221.5 million, EBITDA rise 18% to $38.6 million, and underlying net profit after tax jump 27% to $27 million. Underlying earnings per share also rose 27% to 12.6 cents. The board declared an unfranked dividend of 4.5 cents per share, increasing its full year dividend to 9 cents per share. This represents a payout ratio of 71%.

The key driver of growth was the company's Wealth Management segment which saw revenue increase 26% to $155.1 million and EBITDA increase 52% to $46.2 million. Contributing strongly to this growth was its increasingly popular Sonata wealth management solution. Sonata revenue increased 32% to $122.5 million in FY 2018, representing 79% of its Wealth Management segment revenue and 55% of total company revenue. Sonata achieved client wins in all key markets, comprising the UK, Australia, New Zealand, and South Africa.

This strong performance offset a spot of weakness in its Fund Administration segment. Despite a solid second half, in FY 2018 Fund Administration segment revenue fell 4% to $66.4 million and EBITDA dropped 16% to $26.7 million.

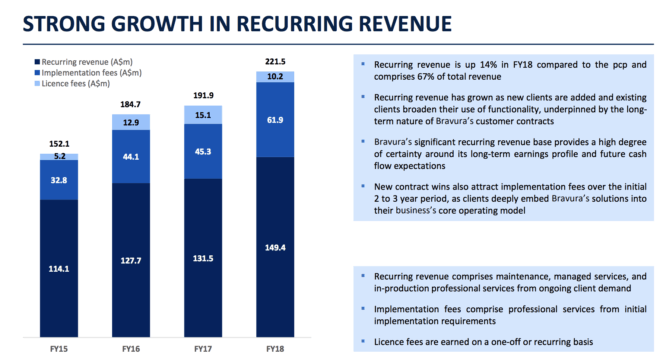

One highlight, in my opinion, during the year was the recurring revenue growth that Bravura Solutions achieved. As you can see above, recurring revenue grew 14% during the 12 months and now comprises 67% of total revenue.

Outlook.

Management believes that Bravura Solutions is well placed to take advantage of strong demand in the UK, Australia, New Zealand, and South Africa. It expects its Wealth Management and Funds Administration segments to grow in FY 2019.

In light of this and its strong recurring revenue and new sales opportunities, management expects earnings per share growth in the mid-teens in FY 2019.

Should you invest?

I think Bravura Solutions is a quality company and one of the best options in the fintech industry right now alongside the likes of Afterpay Touch Group Ltd (ASX: APT) and Praemium Ltd (ASX: PPS).

Based on this result its shares are changing hands at 33x underlying earnings. While this is a premium to the market average, I believe it is about fair for its current growth profile.