The Medibank Private Ltd (ASX: MPL) share price sank like a stone on Friday morning before recovering as the day went on.

In afternoon trade the private health insurer's shares are down just 2% to $3.11. At one stage Medibank's shares were down as much as 7% to $2.95 after its full year results fell short of expectations.

Here is a summary of how Medibank Private performed in FY 2018 compared to a year ago:

- Revenue rose 1.6% to $6,906.4 million.

- Premium revenue up 1.2% to $6,319.5 million.

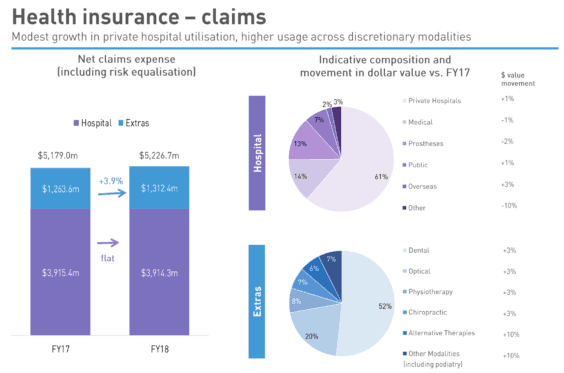

- Net claims expense rose 0.9% to $5,226.7 million.

- Group operating profit up 9.7% to $548.8 million.

- Net profit after tax fell 1% to $445.1 million.

- Earnings per share of 16.2 cents.

- Dividend per share of 12.7 cents.

- Outlook: Expects flat PHI market volumes to persist but targeting modest market share growth.

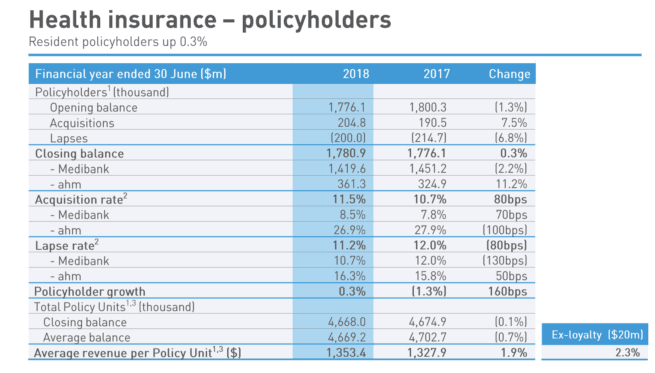

As you can see below, the modest top line growth was driven by a small rise in policyholders and a 1.9% increase in average revenue per policy unit. While policyholders fell 2.2% to 1,419,600 for the Medibank brand, this was offset with an 11.2% increase in policyholders to 361,300 for the ahm brand.

Unfortunately, the growth in revenue was partially offset by a rise in claims. Although Hospital claims remained flat year on year, Extras claims rose 3.9% during the year. This is shown on the charts below.

Should you invest?

I felt this was a soft result and wasn't surprised to see investors hitting the sell button today.

After all, based on its result today, Medibank's shares are changing hands at a little over 19x earnings. This is a premium over the market average, which I think makes its shares reasonably expensive given its profit decline this year and soft outlook for FY 2019.

Because of this, I intend to avoid Medibank for the time being along with other healthcare shares that may struggle from the tough trading conditions such as Ramsay Health Care Limited (ASX: RHC) and Healthscope Ltd (ASX: HSO).