The Webjet Limited (ASX: WEB) share price has stormed 12.5% higher to $16.31 in morning trade after the online travel agent released its results for the 12 months ended June 30.

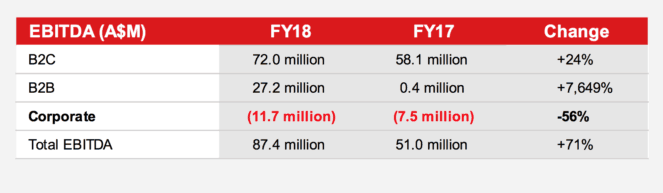

Investors have responded positively to the company revealing that its continuing operations achieved a 54% increase in total transaction value (TTV) to $3,012 million, a 54% lift in revenue to $291 million, a 71% rise in EBITDA to $87.4 million, and a 63% increase in net profit after tax (before acquisition amortisation) to $55.7 million.

On a per share basis, earnings before acquisition amortisation came in at 48.4 cents and 37.5 cents including it. This strong performance allowed the board to declare a final dividend of 12 cents per share, lifting its total dividend to 20 cents per share.

The driver of this strong result was the increasing popularity of Webjet's numerous brands which led to all sides of its business achieving robust bookings growth in FY 2018.

The Webjet OTA segment saw bookings rise 10% to 1.55 million. Webjet OTA's booking growth was more than 3 times the rate of the market growth, meaning its share of the domestic and international flight markets has grown to more than 5% and 3%, respectively. Thanks to ancillary products and scale, the segment experienced a 473bps increase in its EBITDA margin to 40.3%. Segment EBITDA rose 36% to $58.7 million during the year.

The company's Online Republic segment delivered 12% bookings growth in FY 2018. However, the introduction of the Netflix tax and lower contributions from its Cruise business meant that its EBITDA margin fell 792bps to 42.1%. This offset bookings and revenue growth and resulted in a 11% decline in EBITDA to $13.3 million.

Webjet's B2B Hotels or WebBeds segment achieved bookings growth of 214%. While the segment benefitted from the acquisition of JacTravel, organic bookings growth still rose an impressive 79% in FY 2018. Pleasingly, the B2B segment has a strong geographical footprint and is experiencing growth from all regions. Bookings grew 109% in AMEA, 235% in Europe, and 530% in Asia, leading to the segment making a meaningful contribution to the company's overall earnings. This can be seen below.

Webjet finished the year with operating cash flow of $137.1 million and a cash conversion of 159%. The company repaid $24.6 million of debt during the year, but borrowings still increased $73.2 million to $122.7 million. This was largely due to the JacTravel acquisition involving $100 million of debt funding.

Outlook.

Management believes the company is well positioned and has substantial headroom for ongoing bookings growth as the B2C market continues to shift online. It sees significant growth opportunities in Packages and intends to continue improving its ancillary offerings to meet growing customer demand for a wider choice of travel products.

In light of this, it has reiterated its bookings growth targets for FY 2019 and FY 2020 for both its B2C and B2B businesses. These target bookings growth rates of more than 3 times the underlying market for B2C and more than 5 times the underlying market for B2B.

In addition to this, the company continues to look for opportunities to expand its directly contracted inventory by leveraging existing contracting staff in all regions, as well as through strategic acquisitions.

Should you invest?

I thought this was an impressive result from Webjet and can't say I'm surprised that its shares have rocketed higher today. Despite this strong gain I still see value in them for long-term investors, especially with the shift to online booking continuing to gather pace.

At around 34x earnings its shares are not cheap, but I believe it is a fair price to pay given its growth profile. Webjet remains my favourite in the industry ahead of the likes of Helloworld Travel Ltd (ASX: HLO), Corporate Travel Management Ltd (ASX: CTD) and Flight Centre Travel Group Ltd (ASX:FLT).