After a shaky start to the day the Virtus Health Ltd (ASX: VRT) share price has pushed 3% higher to $5.62 in early afternoon trade following the release of the assisted reproductive services (ARS) provider's full-year results.

For the 12 months ended June 30, Virtus achieved revenue growth of 2.2% to $262.1 million and flat before interest, tax, depreciation, amortisation and impairment of $65 million. Reported net profit after tax attributable to ordinary equity holders came in 9.4% higher at $30.8 million and earnings per share was 9.3% higher year-on-year at 38.26 cents.

Management declared a final fully franked dividend of 12 cents per share, bringing its full-year dividend to a fully franked 26 cents per share. This equates to a yield of 4.6% based on its current share price.

The company's key Australian segment performed well and achieved EBITDA growth of 1.6% to $66.8 million despite the softening of the domestic market in the second half of FY 2018. The successful implementation of cost out and operational efficiency initiatives helped lift margins and was underpinned by market share gains in New South Wales.

However, total cycle volume in Virtus Australian clinics still decreased 3.4% to 15,235 cycles during the year. This was caused by low cost competition in Queensland's economically challenged market and new competition in a contracting Tasmanian market. Rival Monash IVF Group Ltd (ASX: MVF) has also suffered from the same headwinds.

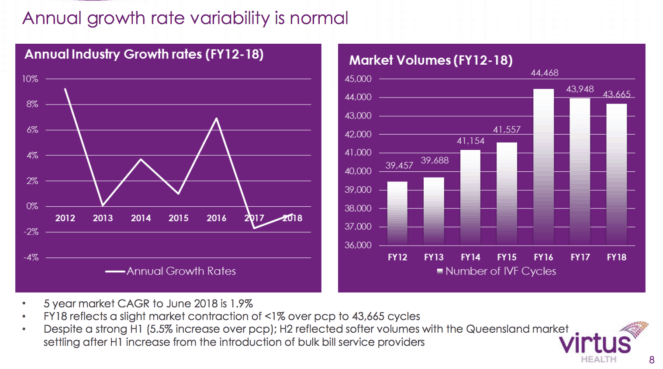

During the year Virtus full service activity fell 2.5% and The Fertility Clinic (TFC) activity declined 9.2%. The chart below demonstrates how soft the Australian market is right now after peaking in FY 2016.

Virtus' Australian Diagnostics segment performed well in FY 2018 and delivered both revenue and EBITDA growth. Segment revenue rose 3.6% and EBITDA climbed a sizeable 9.1% thanks to strong IVF activity in the first half, continued growth of pre-implantation genetic diagnosis and pre-implantation genetic screening (PGD/PGS), and significant operational improvements.

The same could not be said for its Australian Day Hospital segment which recorded flat revenues despite a 6.6% increase in IVF activity. A 5.3% decline in non-IVF procedure revenue was largely to blame.

The company's international operations were a highlight in FY 2018 and delivered strong growth. International revenues grew 17.6% to $44 million and EBITDA increased 29.5% to $9.2 million. Virtus' Irish business continued its solid run and was supported by an improved performance from its Singapore business. The latter achieved a full year positive EBITDA for the first time.

The segment should be given a boost in FY 2019 from earnings accretive acquisitions in the UK and Denmark that were made during the year.

Outlook.

Management stopped short of providing any real guidance for FY 2019. Instead it stated that it felt the company was well positioned for continued growth due to its diversified model, scale, and its geographical reach which it feels provides an unrivalled platform for participation in all key fertility segments.

Should you invest?

The arrival of Primary Health Care Limited (ASX: PRY) in the industry has been a real blow for Virtus and Monash IVF at a time when trading conditions were softening due to lower cycle volumes. But I've been impressed at the way Virtus' business model has coped with this and continued to deliver profit growth.

I expect this solid growth to continue in the future, allowing the company to grow earnings and its dividend at a decent rate. As a result, I think this could make it a good option for investors in search of income.