The Kogan.com Ltd (ASX: KGN) share price will be on watch today after the e-commerce company released its full-year results.

For the 12 months ended June 30 Kogan posted gross transaction value of $492.6 million, revenue of $412.3 million, and a net profit after tax of $14.1 million. This was a year-on-year increase of 47.3%, 42.4%, and 110.4%, respectively.

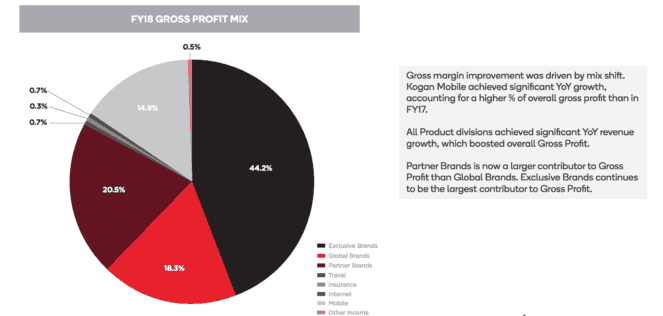

As you may have noticed, the company's profit growth outpaced its revenue growth by some distance in FY 2018. This was partly due to gross margin expansion during the year. Kogan's gross margin expanded 1.6 percentage points to 19.5% as a result of growth in Kogan Mobile and a positive shift in mix among its product divisions. In addition, the business is continuing to experience significant operating leverage.

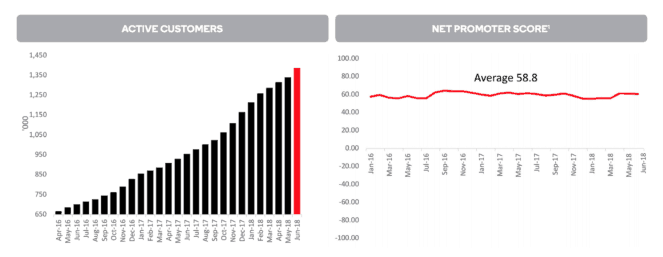

A key driver of its strong revenue and profit growth was a 45.3% increase in its active customer base to 1,388,000, as shown above. Management advised that the Kogan brand, new verticals, and strategic marketing initiatives were largely behind the rise in customer numbers. Furthermore, Kogan's positive net promoter score of 58.8 is likely to underpin repeat visits from these customers. This appears to be why 68% of Kogan's traffic is from free sources and only 32% comes from paid marketing.

As you can see below, the company's Exclusive Brands segment continues to be the largest contributor to its gross profit. Revenue in the segment grew 39.6% year-on-year to $130 million as the company continued to meet strong consumer demand across a wide-array of products.

This was supported by strong growth in its Partner Brands and Global Brands segments which saw revenue increase 46% to $99 million and 38.1% to $163.2 million, respectively. This led to the entire Product Division generating revenue of $392.2 million, up 40.5% on FY 2017's result. While strong growth was exhibited by its Travel and Mobile businesses, the revenue generated is not yet meaningful and had little impact on its overall result.

Kogan generated operating cash flow before capital expenditure of $31.7 million in FY 2018, resulting in an operating cash conversion of 122.9%. This allowed the Kogan board to declare a fully franked final dividend of 6.1 cents per share, bringing its full-year dividend to 13 cents per share.

The company has not provided any guidance for FY 2019 but intends to release an update on its trading performance at its annual general meeting in November.

Should you invest?

According to the Bloomberg consensus, the market was anticipating a net profit after tax of approximately $15.4 million today. However, with its shares down considerably from their 52-week high, this miss could already have been factored into its share price.

In light of this, it is difficult to predict how the market will react to this result.

But if its shares do come tumbling lower then I would suggest investors consider picking them up on the cheap. After all, Kogan is a quality company with a long runway for growth that I believe would be a great buy and hold investment along with fellow growth star Afterpay Touch Group Ltd (ASX: APT).