This morning, Rural Funds Group (ASX: RFF) reported its annual result to 30 June 2018 showing continued growth in rental profit.

Total adjusted funds from operations (AFFO), a measure of Rural Fund's property cash rental business, grew by 26% to $32.3 million. On a per unit basis, AFFO grew by 1.6% from 12.5 cents to 12.7 cents. The new units issued in the past hampered this year's growth.

The distribution of 10.03 cents for FY18 has long been signalled to the market and was a 4% increase compared to the FY17 distribution. This represents a payout ratio of 79% of AFFO.

Pleasingly, management have provided a forecast of 4% growth for AFFO per unit to 13.2 cents and a 4% growth of the distribution to 10.43 cents in FY19. The forecast payout ratio of 79% provides capacity for continued distribution growth and re-investment into assets for income growth.

Prior to the recent equity raising, Rural Funds managed to grow the adjusted net asset value (NAV) per unit by 6% to $1.68 during the year to the end of FY18. The adjusted NAV includes water entitlements at fair value instead of at cost. Had the JBS-related transactions occurred by 30 June 2018 the pro-forma adjusted NAV would have improved further to $1.72.

With the additional cattle properties Rural Funds now has 44 properties with an average weighted average lease expiry (WALE) of 12.3 years, which is one of the longest in the REIT sector.

An interesting trend to note is that Rural Funds' rental indexation has shifted more towards fixed indexation. Fixed indexation was 35% of the rental income at the end of FY17, but it has grown to 41% using the pro-forma FY18 figures. This seems like a good move considering how sluggish inflation is currently.

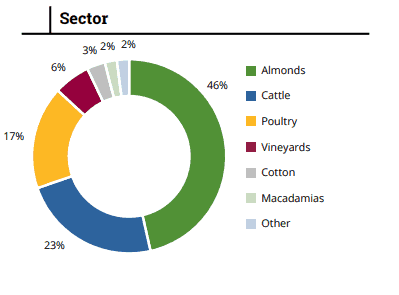

Rural Funds has worked hard at diversifying its farm assets over the past two years, particularly expanding its cattle exposure, as can be seen on the below image:

You may be wondering how the current drought is affecting Rural Funds. Firstly, the REIT doesn't carry the operational risk – that's for the agricultural tenant. Second, assets are leased with sufficient water entitlements considering factors such as sector type and the average rainfall of the assets' location. Finally, Rural Funds' properties are, at worst, on the edge of the most-affected areas. Indeed, Rural Funds Management (RFM) reported it is business as usual for lessees.

RFM continues to pursue opportunities to expand the fund, with a focus on additional natural resource assets in the cattle and cotton sectors. Assets such as these offer growth potential relating to improvements in productivity and value, and complement infrastructure predominant assets such as recently acquired cattle feedlots.

Rising interest rates remain a key risk for REITs like Rural Funds as both the interest cost and property values could be negatively impacted. However, Rural Funds currently has a low effective cost of debt at 4% with a healthy amount hedged for over seven years at a low rate.

Foolish takeaway

Rural Funds continues to grow its rental profit per unit and the distribution, which is the main things you want from this quality property landlord.

Management are confident that Rural Funds can continue to grow the distribution by 4% per annum for the foreseeable future.

Although it's trading at a decent premium to its NTA I think Rural Funds looks like one of the most attractive income shares on the ASX with a FY19 distribution yield of 5.1%.