The Insurance Australia Group Ltd (ASX: IAG) share price fell 8% to $7.59 this morning after releasing its full year results. Revenue rose 2.6% to $16,411 million and net profit from continuing operations rose 1% to $947 million.

Statutory profit after tax fell 0.6% to $923 million, owing to some one-off costs associated with the closure of discontinued operations.

IAG reported fully-franked full year dividends of 34 cents per share, or approximately a 4.5% dividend yield at a share price of $7.60. Earnings per share were essentially flat at 39.06 cents per share, up from 39.03 cents per share last year.

IAG reported it had net tangible assets (NTA, or "book value") of $1.47 per share.

One interesting factoid that will stand out to investors is that the Royal Commission cost IAG approximately $10 million dollars.

IAG also absorbed around a $290 million reduction in gross written premium (GWP; a measure of insurance sold) owing to some CTP insurance reforms, a discontinued motorcycle insurance business, and adverse foreign exchange rate movements in New Zealand.

IAG also intends to return approximately 25 cents to shareholders later this year or early next year, comprising of a 19.5 cents per share capital return and a 5.5 cents per share special dividend.

This is subject to shareholder approval at the annual general meeting (AGM) in November. The capital reduction is due to IAG's quota share arrangement with Berkshire Hathaway, which effectively reduces the amount of capital that IAG needs to hold.

One notable change during the year is IAG announcing its intention to sell its businesses in Thailand, Indonesia, and Vietnam. This is an interesting decision given that the Asian businesses have, in the past, been touted as a source of growth for the company. It appears that IAG will retain its businesses and joint ventures in India, Malaysia, and Singapore.

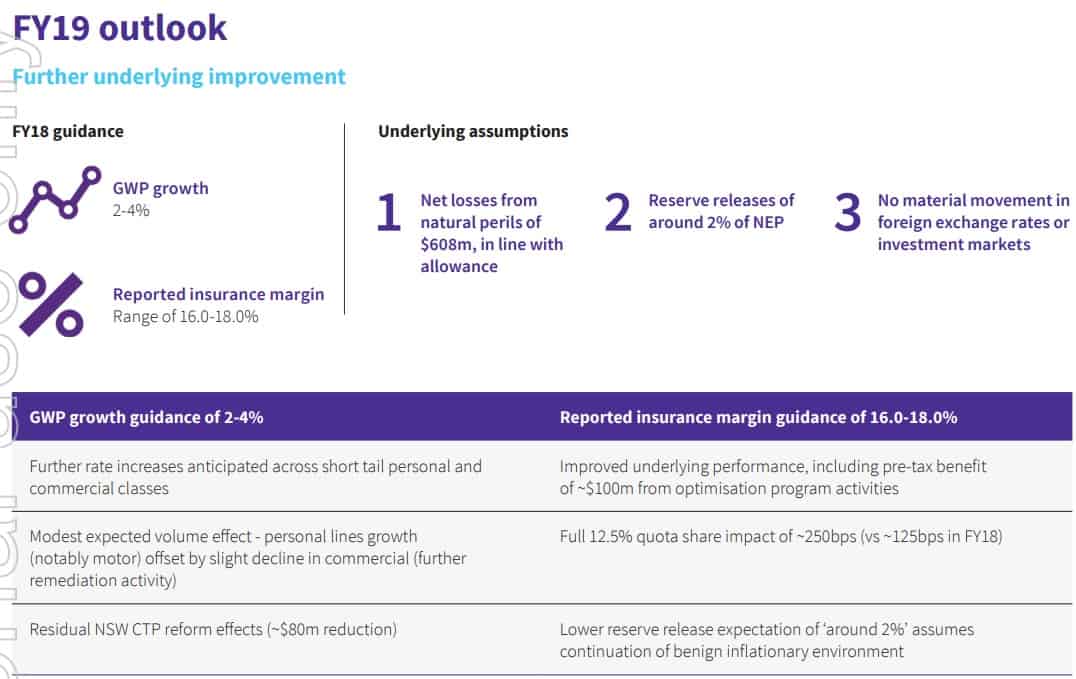

The full year outlook for financial year 2019 is somewhat more rosy:

However the insurance market remains competitive and in previous years IAG has walked its guidance back due to pressures that emerged. In my opinion the forecast growth, even if it fell short, is not substantial enough to make a significant near term difference to the value of IAG shares.

QBE Insurance Group Ltd (ASX: QBE) will be expected to report its annual results later this month also (tomorrow, I believe), and it will be interesting to compare the different outlooks for the businesses. We'll have full coverage of QBE for you then.

Back on IAG, in my opinion, it's hard to escape the feeling that IAG's ongoing financial tinkering is a tacit admission that the company is not sure how to grow the business further.

By selling businesses, quota-sharing with Berkshire Hathaway, and returning capital to shareholders, IAG is essentially shrinking its business slightly and engineering its way to higher margins and a higher return on equity.

There's nothing wrong with that, but the fact that this is where the company is concentrating its effort says to me that the business will likely struggle to grow at more than a couple of percent per annum. That means that, as a mature business with limited growth expectations, the price investors pay for IAG is very important. If you overpay, you will receive lower returns over a long term holding period.

In my opinion, given that IAG pays out most of its profit as dividends, I would want to receive around a 6% dividend to compensate me for owning IAG, given that the business will not be likely to grow much.

The current dividend yield of around 4.5% suggests that the company is fully priced (and is possibly due to investors bidding up shares to receive the capital return later this year). As a result I would be inclined to wait for a dip before buying shares in Insurance Australia Group.