The Genworth Mortgage Insurance Australia (ASX: GMA) share price rose 3% to $2.76 this morning after the company released its half year results to 30 June 2018. Here's what you need to know:

- New insurance written fell 21% to $10.3 billion

- Gross written premium grew 46% to $267 million, although not all of these will flow through to Genworth due to reinsurance arrangements

- Net earned premium fell 32% to $143 million

- Net profit after tax fell 53% to $42 million

- Earnings per share of 8.9 cents per share

- Dividends of 8 cents per share plus a 4 cents per share special dividend

- Reported loss ratio ballooned from 35% to 53%

- Portfolio delinquency rate rose 0.03% to 0.54%

So what?

Genworth continues to struggle with insurance volumes, as lenders appear to be lending less in response to tighter lending requirements implemented by APRA, as well as interest rates which have recently started to increase at the big banks.

As mortgage insurance is only required on the riskier loans, by placing limits on riskier (interest only/investor) loans, the regulators are effectively shrinking Genworth's business. While Genworth has made new investments by starting businesses outside of mortgage insurance (which is itself a sign of how tough the market is) it is likely that the company continues to struggle.

One positive for now is that bad loans remain at modest levels, although these appear likely to increase following the reduction of interest only lending, the increase in loan rates, and the potential switchover of some interest-only borrowers to principal & interest.

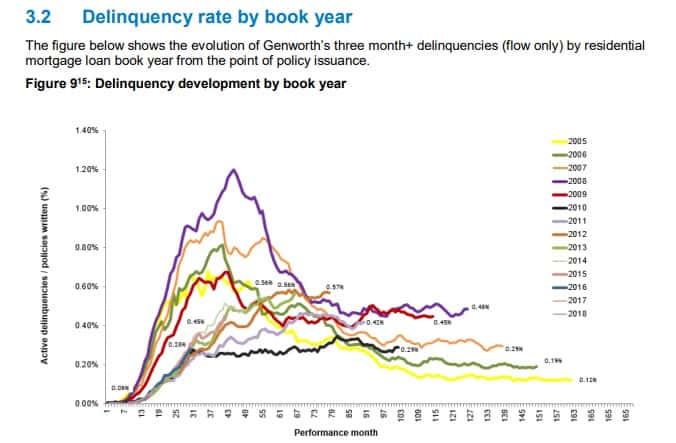

Here is a chart of Genworth's bad loans by year of origination:

It's not easy to see the loans from 2016-2018 (bottom left corner) but these will be the lines to watch in the coming years. Older loans are a lesser risk due to the amount of repayments and house appreciation since then. Newer loans taken at a 80% loan to valuation ratio in 2017 are substantially more risky and more vulnerable to changes in interest rates.

Note the big spike in delinquencies in 2007 and 2008 (purple and orange lines). These show what a bad scenario can look like – and in fact the GFC was very modest in terms of its impact on Australia. A true housing bear market could look substantially worse.

Now what?

Genworth is an interesting situation that I have followed for a while, although I have never owned shares in it. It is an insurer that appears to be overcapitalised – which means that it has far more capital than it needs to weather likely losses on its policies. On this metric, the company appears quite "safe".

On paper there is a good case for value being added here. With net tangible assets of $3.95 per share, by buying back its own shares at the current price of ~$2.70, Genworth is quite literally buying $3.95 worth of assets for just $2.70 – a 32% discount.

However, Genworth's estimate of its assets depends massively on how much they have assumed they are going to lose on policies. In very simple terms, Genworth's assets are calculated as the assets it has (mostly bonds), minus unearned premiums and the money reserved for paying actual and estimated losses.

Australia has had a robust 26 years with no recessions and interest rates have fallen almost every year since the GFC, so the lending industry has been given a huge free kick.

A big question is what happens if the economy starts to struggle and house prices fall, and that is a question I've never been able to answer with a high degree of confidence. So while Genworth is an interesting business, it still faces substantial headwinds and remains in my too hard basket.