In morning trade the Telstra Corporation Ltd (ASX: TLS) share price has edged higher after announcing a new organisational structure and leadership team.

At the time of writing the telco giant's shares are almost 0.5% to $2.77.

What was in the update?

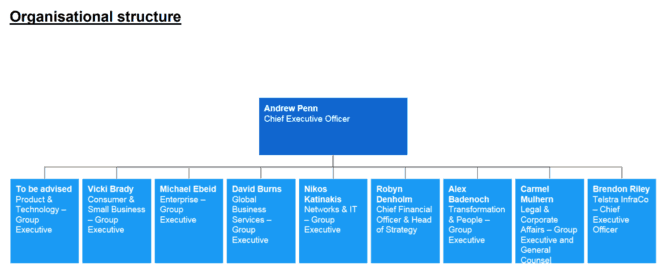

According to the release, effective from October 1 Telstra will have a new top line organisational structure and leadership team.

CEO Andrew Penn believes this is an important step in delivering its Telstra 2022 strategy and will help to ensure that it delivers rapidly and effectively on all commitments made to its customers and the market at its recent investor day.

He stated that: "At the heart of these changes is the simplification of our products and services built on new technology. By mid-next year we will have fully rolled out our market leading products and services. To help deliver these changes, we are announcing a new end-to-end products and technology division of Telstra. It means we will significantly increase our technical capabilities around product development and management."

Telstra's under pressure CEO believes that the changes will allow it to deliver market-leading innovation in networks and support the build out of 5G and Internet of Things.

The simplified and streamline structure, which can be seen above, aims to remove "duplication, hierarchy and silos across the organisation." This is expected to improve customer service, the efficiency of the business, its competitiveness, increase productivity, and ultimately reduce costs.

As part of the reshuffle there will be a number of new faces and the exit of some long-standing executives. One notable exit is the company's CFO Warwick Bray. He has been in the role since 2015 and "led the delivery of approximately $700m pa in core fixed cost reduction, introduction of a new capital management framework and driven insight into Telstra's financial performance through nbn structural change."

Should you invest?

While I think that this is a step in the right direction, I wouldn't be in a rush to invest. There's still a long way to go until these changes have an impact and trading conditions could yet get tougher for Telstra and its peers TPG Telecom Ltd (ASX: TPM) and Vocus Group Ltd (ASX: VOC).

I would suggest investors keep their powder dry until there are signs of improvement.