Those digging around for clues on the stocks that could outperform during next month's profit reporting season might be keen to know what fund managers are actively buying.

The latest fund manager survey by JP Morgan provides some interesting insight into what this group of professional investors are doing and thinking in June, and there are three key takeaways that every retail investor should be aware of.

The first is that energy company Oil Search Limited (ASX: OSH) and global logistics group Brambles Limited (ASX: BXB) are the latest hot favourites among fundies based on JP Morgan's "Love Index".

The share prices of both stocks are outperforming this morning with Oil Search surging 2.2% to $8.90 and Brambles jumping 1.6% to $9.86 when the S&P/ASX 200 (Index:^AXJO) (ASX:XJO) index is up 0.9%.

Both stocks moved into the "well held" category of the ASX 200 stocks owned by fundies. The popularity of Oil Search is probably driven by the resilience of the oil price, while bargain hunters were probably betting that Brambles will turn a corner after its underperformance over the past year.

The second interesting finding is that the unloved financial sector is piquing the interest of fundies. The sector is still under-represented in the holdings of these investors but the underweight gap to the rest of the other sectors is narrowing.

This is due to fundies adding exposure to UK dual-listed bank CYBG PLC/IDR UNRESTR (ASX: CYB) – better known as Clydesdale Bank, investment bank Macquarie Group Ltd (ASX: MQG) and our largest mortgage lender Commonwealth Bank of Australia (ASX: CBA).

However, it's not overseas institutions that are buying Commonwealth Bank but local investors. If anything, international fundies are dumping the stock.

The third takeaway is that institutional investors are bullish despite threats of a global trade war, rising bond yields and talk of a painful correction on equity markets.

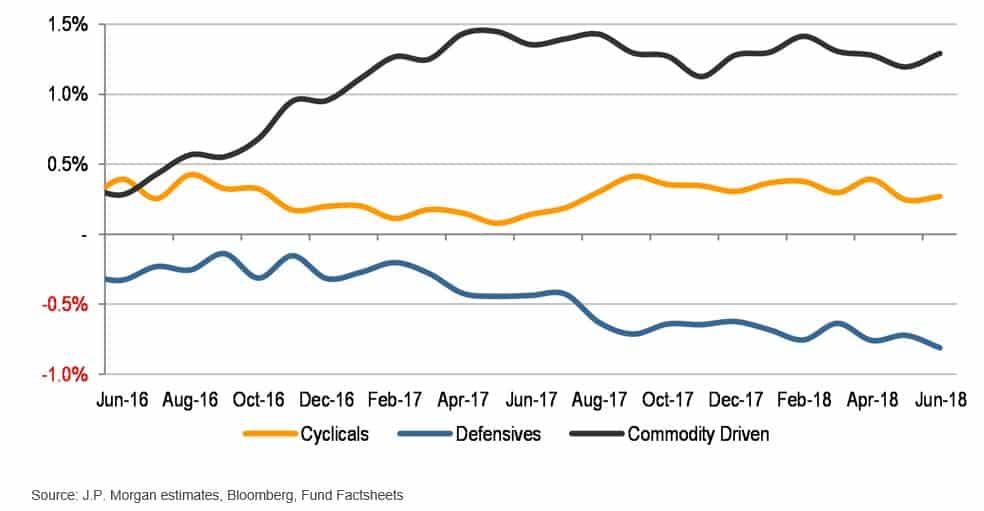

Feeling Bullish: average fund manager positioning (note cyclicals excludes REITs)

Their upbeat take on risk assets is reflected in their capital allocation decision with commodity exposed stocks (such as miners and energy producers) at the top of their buy list, while cyclicals (stocks most impacted by economic cycles) are also in the "overweight" territory.

In contrast, defensives are out-of-favour with the level of under-representation in portfolios slipping further in June even as cash holdings by fundies remain elevated.

This is a somewhat interesting contradiction. Fundies are feeling nervous about the market (and that's why they are so cashed up) but they are selling defensive stocks to buffer up their cash holdings and to fund further buying in commodity driven stocks.

Perhaps what this is really saying is that fundies are not as worried about the health of the global economy as some media reports suggest, but are building their war chest to buy cyclical growth stocks on any market dip.

On that happy note, the experts at the Motley Fool are urging investors to have a look at stocks in a niche sector which they believe will make a big impact on markets in FY19 and beyond.

Click on the free link below to find out what this sector is and the stocks that are best placed to benefit from this emerging boom.