Oil Search Limited (ASX: OSH) shares opened lower on the ASX this morning after the company announced that its H1 2018 revenue was down 18%.

The February 2018 PNG Highlands earthquake stopped production during the period with some production only coming back online in late April.

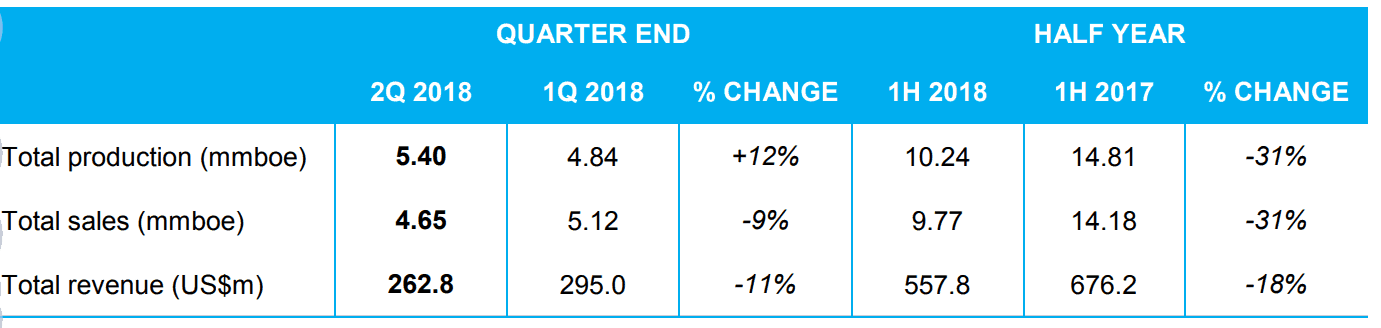

During the half, Oil Search sold 9.77 million barrels of oil equivalent (mmboe), 31% lower than 1H 2017 although higher global oil prices offset the decline of total revenue to US$ 557 million (an 18% decline from 1H 2017).

Below is a summary of Oil Search's production and sales for the last quarter and half year:

Source: Oil Search ASX announcement.

Counting the cost of the earthquake

The earthquake has setback Oil Search in a number of ways including:

- The Agogo production facility and the Agogo & Moran fields remain closed even today

- A higher proportion of LNG cargoes had to be sold on the spot markets at lower prices

- Gross insurance recoveries of US$150 million – US$250 million are likely to lead to higher insurance premiums in the years ahead as insurers aim to recover their costs

- Lower production levels led to higher unit costs (given fixed costs of operation) leading to lower profitability

- Lower operating cash inflows and cash balances

Oil price outlook

Interestingly, hidden in all the information that Oil Search disclosed, the company noted that their oil price outlook assumed, "more conservative prices than current levels".

This echoes the sentiment by other market commentators such as Barclays who forecast that oil prices could fall. If oil prices do fall, it would have negative consequences for other Australian oil producers such as Beach Energy Ltd (ASX: BPT), Santos Ltd (ASX: STO) and Woodside Petroleum Limited (ASX: WPL).

Foolish Takeaway

I think overall it highlights the impact that natural disasters such as earthquakes can have on commodity shares like Oil Search and insurers like QBE Insurance Group Ltd (ASX: QBE).

Oil prices, as well as other factors that are market- or sentiment-driven, have a massive impact which makes the predictability of these businesses' success a challenge.

That's where a well-diversified portfolio can come in handy.

Why don't you consider diversifying your portfolio with these 4 shares which our team of experts have identified as the best shares to buy right now.