I don't know about you, but I'm a little sick of hearing about the banks and the Royal Commission.

I mean, I make myself pay attention, because apathy and disinterest would work in those banks' favour when it comes to the alleged (and sometimes admitted) wrongdoings, but it's tempting to just switch off. If we switch off, they win. So we won't. At least, not entirely.

But today I won't mention them. Okay, I won't mention them again.

Let's get back to investing, shall we?

To a stock market that's within a whisker or two of a ten-year high. (And remember that the stock indices don't include dividends. Add them back and we're well ahead of 2008.)

You don't read too much about that. It's not 'news'.

Instead, we see articles about tax, about business conditions, wage growth, more tax and more wage growth.

Add in some more from the house price permabears, and you've almost got a full house.

It's now going on 4 years since I first noticed that, while the economy and stock market kept growing, the boffins told us it couldn't be true.

The old armed forces truism is that no plan survives its first contact with the enemy.

Except to some commentators and economists, grizzled war veterans are pushovers.

No matter how frequently reality disproved their models and trashed their assumptions, they weren't for turning.

No, the data must be wrong.

Vive le theory!

So many of them keep telling us that the world is still about to end… it's just that the deadline has been pushed back.

What's the difference between a stubborn economist and a Doomsday cult leader?

I have no idea… I was hoping you'd tell me. Buggered if I can tell them apart.

To be clear — and fair — many economists and pundits are only too ready to change their minds. They're just not the ones that get the headlines.

I'm fortunate to be on Sky News Business with some of the best, from time to time, but I rarely see their names in the headlines. Because they're not the stubborn or outlandish types.

Next stop is the housing permabears. These are the guys (and they're almost all guys) who, having seen house prices double and triple while they screamed 'overvalued' will nonetheless take a victory lap when (if!) they fall 20%, shouting 'I told you so!'.

You do the numbers… did they really?

And then there's the stockmarket permabears. The ones who told you China would crash. Trump would ruin us all. Valuations couldn't last.

The knuckleheads who predicted an 80% fall in 2016 or who said 'sell everything' 28 or so months ago.

Where are they now?

No, not hiding. No, not apologising.

They're doubling down… because when they're eventually right (and we willhave a market fall at some point) they'll shout… you know it …. "I told you so"

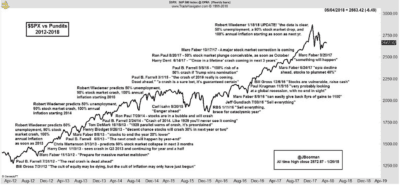

Check out this image.

It overlays the S&P500 over the past six years with a host of Doomsday predictions.

(You can find the tweet, from Jon Boorman, here).

Don't worry if you can't read it — you're not missing anything.

But you know what strikes me?

- Too many pundits make too many 'predictions'

- Too many pundits keep doubling down on the same, bad, predictions; and

- We should really stop listening

Again, let me repeat: market falls will happen. It will feel scary. Some pundits (and I use that term generously) will take victory laps.

But man, has listening to them been expensive!

Not only because they've been wrong, but because those guys — way back to the 70s and likely before — are almost always wrong.

Not only because they're almost always wrong, but because they're betting against both history and common sense.

Have you seen the long term market trend? Sure it's not exactly a straight line, but guess the direction.

Yep, up.

And not just a little bit. A lot.

Yes, 1987 happened. Yes the GFC happened. But you know what was far more expensive than 'losing' money during those times?

Not making money the rest of the time.

Yes, pessimism sounds smart.

Yes, we're wired to fear loss more than we enjoy a similar-sized gain.

And yes, those prognostication headlines can scare the hell out of you.

Unless you know better.

At The Motley Fool, we're long-term bulls. And you know who we have in our corner? Almost every one of the world's most successful investors. Ever.

Including Warren Buffett. Speaking to the annual meeting of his company, Berkshire Hathaway, a couple of weekends ago, he said:

"It works… if you told me at the start that you'd have a Cuban Missile Crisis and you'd have nuclear weapons and you'd have a panic… financial panic and you'd have many recessions and you'd have war in the streets in the late '60s from a divided country you'd say 'why in the hell are you buying stocks?'

"And through it all, American in fits and starts… America really moves ahead. We are always… we survived the Civil War… this country in only less than three of my lifetimes… you go back 263 years, I guess, and Thomas Jefferson is 12 years old… and there was nothing here.

"You've flown in from all over to Omaha today, and you've flown over a country with more than 75 million owner-occupied homes and 260 million vehicles and great universities and medical systems and everything… and it's all a net gain, in less than three of my lifetimes

"We've had these events since I started buying my first stock. This country really, really works, and it always will have lots of disagreements, and after every election you'll have people feeling the world is coming to an end and 'How could this happen?'

"I kept buying stocks, and doing a little bit better all the time.

"I've seen a lot of American public opinion over the years. I've seen a lot of media commentary and headlines… and when you get all through with it, this country has… 6 times the GDP per capita it did when I was born; one person's lifetime, 6 for 1 change.

"Everybody in this room is living better in multiple ways than John D. Rockefeller senior was, who was the richest person in the world during my early years, and we're all living better than he lived.

"This is a remarkable, remarkable country, and we've found something very special

"I would love to be a baby being born in the United States today"

We have a simple choice. Do we want to claim the legacy of Buffett? Or of the pundits?

You know what? It's pretty much just that simple.

You can try to be clever, and predict the future. You can use fancy models, expensive trading systems and listen to charismatic and persuasive doom-and-gloomers.

Good luck with that.

Me? I'm taking the bull by the metaphorical horns.

I'm betting that the future will have a similar pattern to the past. Yes, as the legal eagles say, the past is no guarantee of the future, but do you reckon it's more likely to be similar or different?

If you think it's going to be meaningfully different, good luck. I disagree.

I reckon the forces of human nature, enabled and empowered by Australia's system of democratic capitalism are unstoppable forces. They'll make life better. They'll invent new things, new ways and new opportunities.

The future — the long-term future — is incredibly bright.

I hope you agree.

So forget the doom-and-gloom brigade. Embrace the reality that the path to progress isn't always smooth, but is relentless. And relentlessly upwards.

Here's to the crazy ones, indeed.