The banking Royal Commission has focussed the spotlight on the big four banks Australia & New Zealand Banking Group (ASX: ANZ), Commonwealth Bank of Australia (ASX: CBA), National Australia Bank Ltd (ASX: NAB) and Westpac Banking Corp (ASX: WBC) with many damaging issues being revealed.

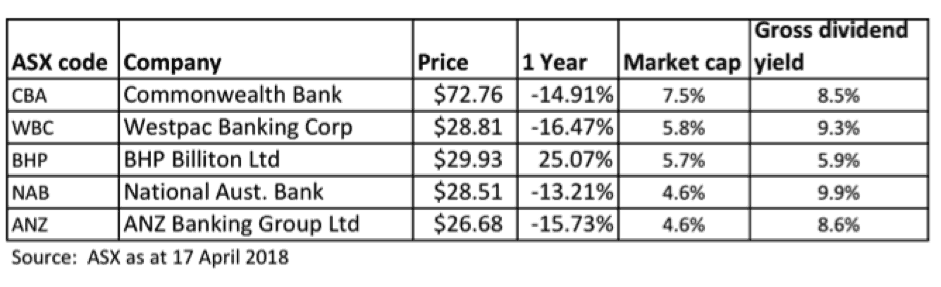

Despite the falling sentiment towards the sector with all the banks seeing double-digit falls over one year (see table below), some investors are likely to be holding on as the banks are still attractive on a yield basis.

All the four banks are paying at least over 8% per annum on a gross yield. BHP Billiton Limited (ASX: BHP) is in the top five companies by market cap but is paying a lower gross yield, although the yield is still relatively attractive.

For many investors, especially those looking for yield, it is a difficult scenario to consider selling some of the highest payers in their porfolios. But, the dangers lurk more around the fact that nearly 30% of the ASX200 is spread across five companies, which many investors are likely to own.

Being diversified is one of the first steps to being a successful investor.

When market volatility becomes an issue having a portfolio spread across different sectors will result in a better outcome, especially if one sector in particular is under pressure.

A DIY investor cannot simulate an exchange traded fund as the logistics and cost makes it impossible, but holding a good mix of companies at least in the top 20-30 market cap weighted makes sense in my opinion.

Even the top 17 market cap weighted companies equate to 50% of the ASX200 and the top 30 is 61% of the market (as at 17 April 2018).

So it is better to be prepared as a portfolio that focuses on the top 5-10 companies is only going do okay if one sector is not under pressure such as the banking sector is now, and there is no market volatility or sharp downturns in the market