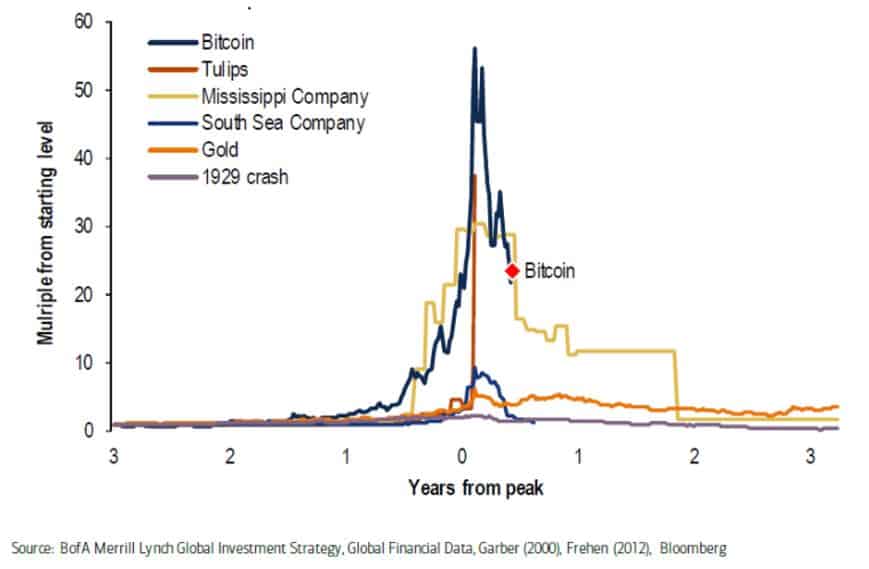

This could arguably be the most spectacular thing on markets to watch in living memory as bitcoin is about to clinch the dubious crown of being the world's biggest bubble in history.

Bitcoin bulls will find this hard to hear but just four months out from hitting its peak of just under US$20,000 a bitcoin, the cryptocurrency is following the same downward spiral as other mega-asset bubbles, according to Bank of America Corp.

There's good news and bad news for the true believes.

Bubble Bubble Toil & Trouble: The biggest asset bubbles in history

The bad news is that the price of bitcoin still has some ways to fall to complete the cycle. Diehards whose hope springs eternal will be praying for a rebound but I am pretty sure we are not going to see the price of bitcoin returning to its peak.

The best days for bitcoin are over. I say this because a few factors will have to come into play before bitcoin has the hope of returning to glory.

First, the pool of true believers in the cryptocurrency will need to expand – and expand dramatically. The sharp 65% plunge in the value of bitcoin from its high has created two groups of backers. The disenfranchised and those practising the art of pray and stay.

There needs to be many more willing buyers entering the market to create a supply shortfall to drive prices higher and I just don't quite see that happening for quite a while.

One issue is the lack of regulations and that will keep most investors away. Interesting, it was speculation that governments would regulate the market that triggered a sell-off in bitcoins not that long ago, but the future of this digital currency (and all digital currencies for that matter) depends on the creation of a structured and regulated market.

As I mentioned, there is talk about government agencies like the US Securities and Exchange Commission (SEC) coming to the party, but they seem to be taking a wait-and-see approach.

But even with a regulated market, this won't be enough to drive the price of bitcoin higher. Bitcoin needs a purpose that extends beyond anonymity. There also cannot be substitutes for bitcoin and there are plenty.

The good news is that bitcoin may not fall to zero regardless of whether this is a bubble. There has been plenty of recognised bubbles that have popped but where the underlying asset(s) still had some value. Look at gold and tech stocks during the 2000 tech boom!

It's taken more than a decade but tech stocks have even managed to come back into fashion. Those hoping for the same for bitcoins will need to master the art of patience.

There are much better alternatives to bitcoin on the ASX. In fact, betting on the next generation of tech disruptors is a much more worthwhile endeavour in my opinion.

The experts at the Motley Fool have uncovered three emerging disruptors that are well placed to outperform strongly in 2018 and beyond.

Click on the free link below to find out that these stocks are.