You only need to see the share price reaction for Wesfarmers Ltd (ASX: WES) to understand why shareholders in Australia & New Zealand Banking Group (ASX: ANZ) should be excited by the news that it is considering spinning off its UDC Finance business.

Wesfarmers share price surged over 6% on Friday and was the best performing stock on the S&P/ASX 200 (Index:^AXJO) (ASX:XJO) when it said it would carve out its Coles supermarket division into a separately listed business.

We might not get as big a share price reaction when ANZ starts trading later this morning as its New Zealand-based asset financing company makes up a much smaller percentage of the bank's total business, but investors should still be excited as research has shown that spin-offs actually add shareholder value.

You only need to think about the strong share price reactions for recent spin-offs to see what I mean. Shares in South32 Ltd (ASX: S32) have leapt around 55% since it cut its apron strings with BHP Billiton Limited (ASX: BHP) in 2015, while CYBG PLC/IDR UNRESTR (ASX: CYB) has rallied just over 50% since leaving the shadow of National Australia Bank Ltd. (ASX: NAB) in 2016.

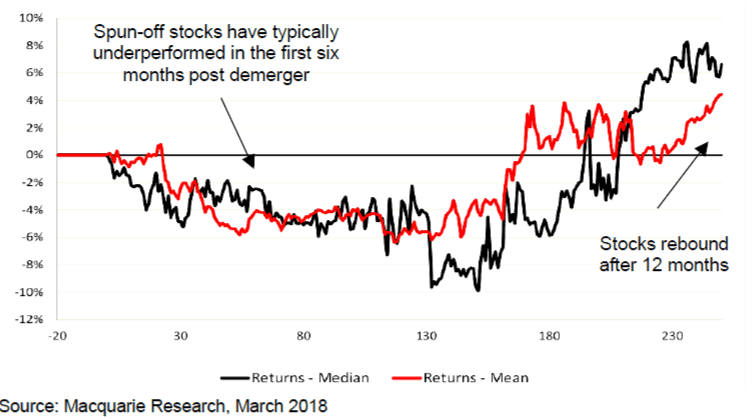

A research note by Macquarie Group Ltd (ASX: MQG) confirms the positive outcomes from demergers. The investment bank looked at 38 demergers on the ASX since 1995 and found that these spin-offs typically underperform the market in the first few weeks of separation and trade sideways for around six months before staging a strong rally.

Child Stars: Excess returns of the child entity following a demerger

These "child" stocks have generated excess returns to the market of around 5% on average in the 12-months post demerger, while their parents are 1.5% ahead of the market.

Shareholders of the parent company are generally given shares in the child entity that is in proportion to their shareholdings in the parent (assuming it is an in-specie distribution as most of such transactions are). This means these shareholders will benefit from the unlocking of value over the 12-month period.

What this finding also says is that investors should buy shares in the child-entity during the initial period of weakness and that you don't actually have to buy shares in stocks like Wesfarmers or ANZ right now if you wanted to capture the upside from the transaction.

The Coles split isn't happening until 2019 and ANZ has not made a decision on what exactly it will do with UDC Finance.

At least now you know what to do when the spin-offs debut on our market.

If you are looking for stocks you should be buying right now, you might like to read the latest free report from the experts at the Motley Fool.

They are particularly bullish on one sector of our market and have identified the stocks best places to ride this investment trend.

Click on the link below to claim your free copy of this report.