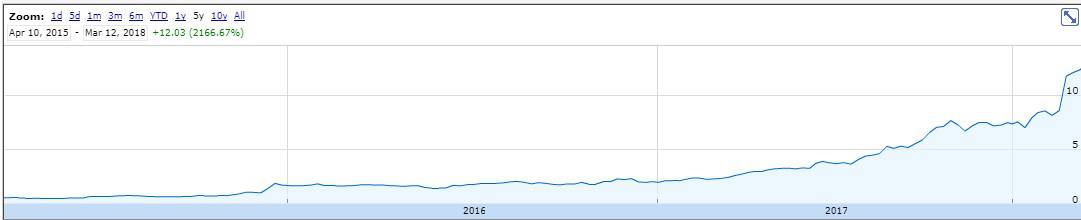

Infant formula and healthy milk business a2 Milk Company Ltd (Australia) (ASX: A2M) has smashed all expectations for growth thus far, as its shares have rocketed from $1.80-ish in 2016 to $12.58 currently:

Earnings have also levitated in that time, with revenues of $353 million and profit of $30.4 million in financial year 2016 compared with revenue of $435 million and profit of $98 million in the first half of 2018 alone.

Can the golden run continue?

That's the key question with a number of factors playing a role. First, albeit not that significant, is a2's superior milk and its intellectual property portfolio. A2 milk lacks the a1 milk protein, which is supposedly the cause of indigestion among people who are thought to be 'dairy intolerant' or 'lactose intolerant'.

A small but growing body of research shows several positive health effects associated with consumption of A2 milk and, although the fresh milk is not the major driver of sales or profits, the company has plenty of room to expand in this area both in Australia and overseas.

However, a major driver of earnings is the Chinese baby formula market, which certainly isn't getting any less competitive. (Most of the earnings growth shows up in the 'Australia' segment in the report, but it's thought that much of the product is being purchased for shipping to China).

Bellamy's Australia Ltd (ASX: BAL) is the other major baby formula player here, but there is plenty of competition coming in including from Blackmores Limited (ASX: BKL) and a bunch of smaller hopefuls.

A2 has done its part to secure supply via deals with its suppliers and the company expects continued growth from increasing interest in A1 protein-free products, as well as the launch of a junior Stage 4 baby formula product in ANZ and China.

I know that I've certainly underestimated how rapidly A2 Milk could continue growing, and I sold a bunch of my shares at $5 and $7. So I wouldn't bet against the company, but the sector is certainly hot and trees don't grow to the sky. As a result if I were to buy into A2 Milk today I would make sure the purchase was just one part of a diversified portfolio.