In morning trade the Nextdc Ltd (ASX: NXT) share price has jumped 14% to a record high of $6.95 following the release of the data centre operator's half-year results.

For the six months ended December 31, NEXTDC posted underlying earnings before interest, tax, depreciation and amortisation (EBITDA) of $33.6 million on revenues of $77.5 million. This was a 41% and 32% increase, respectively, on the prior corresponding period.

On the bottom line NEXTDC reported net profit after tax of $8.4 million and earnings per share of 2.9 cents.

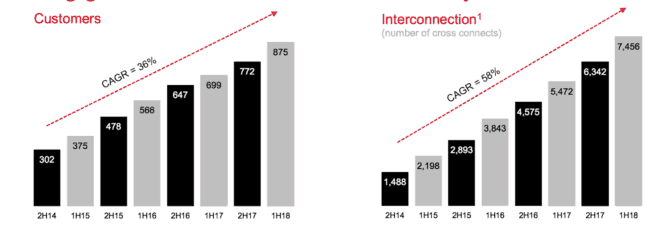

The strong growth in revenue and EBITDA was driven by a sizeable increase in demand for the company's data storage. Contracted utilisation rose 31% on the prior corresponding period to 39.2MW, thanks partly to a 25% increase in customer numbers to 176. NEXTDC also saw demand for Interconnections rise by a solid 36% to 7,456.

The increase in customer numbers and Interconnection that NEXTDC has experienced has made a notably positive impact to its top line and two key metrics – annualised revenue per square metre and per MW. Annualised revenue per square metre has lifted 8.5% since the end of FY 2017 and annualised revenue per MW is up almost 8% during the same period.

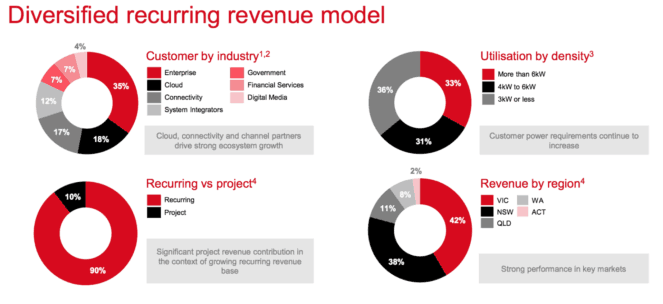

And as you can see on the chart below, the majority of revenue that NEXTDC is generating is recurring. Only 10% of its revenue is project related, whereas 90% is recurring and likely to continue indefinitely.

Pleasingly, this growth looks likely to continue in the future and has led management to upgrade its full-year guidance.

It now expects revenue between $152 million and $158 million, compared to previous guidance of $146 million to $154 million. Underlying EBITDA is expected to be between $58 million and $62 million, compared to previous guidance of $56 million to $61 million. Positively, capital expenditure guidance remains the same at $220 million to $240 million.

Furthermore, I suspect this guidance could potentially be revised even higher in the future. Management has advised that it is in advanced negotiations in relation to several large customer opportunities. Should these come to fruition, they have the potential to result in a significant increase in the company's contracted utilisation base.

Should you invest?

I continue to believe that NEXTDC is one of the best buy and hold investment options in the tech sector alongside the likes of Altium Limited (ASX: ALU) and Appen Ltd (ASX: APX).

While its shares may be expensive, I believe its long-term growth potential more than justifies the premium.